This milestone underscores the growing enthusiasm for Ethereum staking, even as the ecosystem grapples with the implications of the long-awaited Ethereum ETFs. The new exchange-traded funds, unlike their underlying asset, won’t be able to stake their holdings due to regulatory constraints.

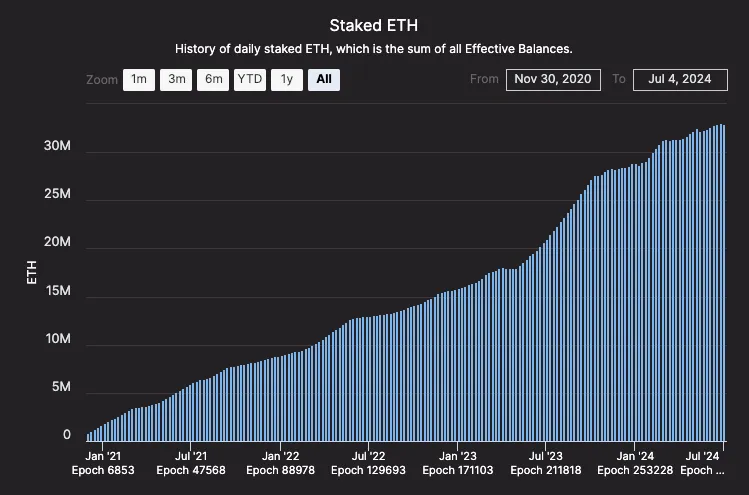

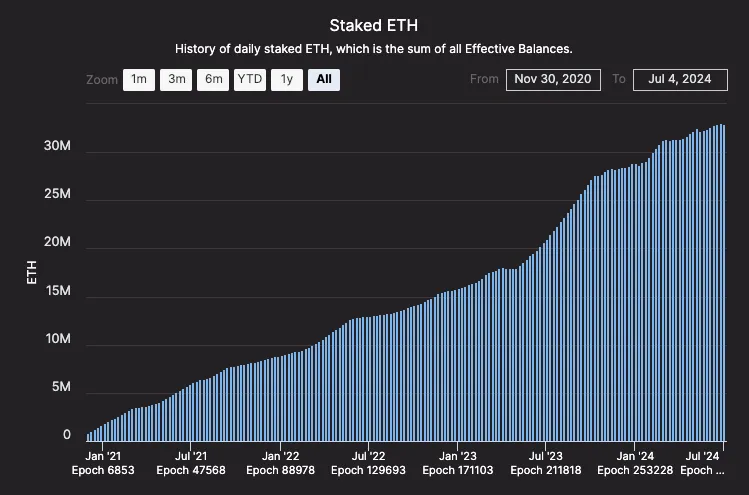

The rise in staked ETH has been steady, with a brief slowdown following the Shanghai upgrade in spring 2023. As of this writing, Ethereum is trading just below $3,000, down 14% over the past week amid broader market volatility.

The SEC’s approval process for Ethereum ETFs has been slower than initially expected. Bloomberg ETF analyst James Seyffart noted on Twitter (aka X), “We’re thinking these things could potentially list later next week or the week of the 15th at this point.”

This comes after Bitwise filed an amended S-1 form ahead of the July 8 deadline, potentially indicating that the products are nearly ready for launch. VanEck then filed its own amended S-1 on Monday.

Evan Van Ness, a prominent Ethereum researcher, offered insights on the staking situation. “We definitely don’t need this much ETH staked, given how Ethereum proof-of-stake has so many times more economic security than proof-of-work,” he told Decrypt.

He also cautioned about centralization risks: “If your staking pool is running a majority client or runs in the cloud, you are putting your ETH at risk.”

The inability of ETFs to stake has spurred innovative approaches from traditional finance players. Franklin Templeton, managing $1.6 trillion in assets, is planning to launch a fund focused on altcoins and staking rewards, unnamed sources with knowledge of the firm told The Information.

Meanwhile, Toronto-based Purpose Investments already has an Ethereum fund that’s allowed to stake the underlying ETH.

“We’ve always been excited about Ethereum and what the technology and ecosystem represent,” he said in a press release. “Initially, a corporate structure was the best option; now we believe an ETF is the most efficient.”

The flurry of activity around Ethereum staking and ETFs raises questions about the future of the ecosystem, too. As more institutional players wade into staking waters and the percentage of staked ETH climbs, the Ethereum community will be watching closely to see how these developments impact the network’s security, decentralization, and overall health.

Danny Ryan, an Ethereum Foundation researcher, shared his thoughts on staking economics at the EthStaker Staking Gathering last year. “Staking on Ethereum is influenced by reward curves and overall economic incentives built into the protocol,” he said. “The goal is to create a sustainable and secure system that encourages participation and maintains the network’s integrity.”

The recent market downturn, attributed to factors such as the imminent Mt. Gox repayments and macroeconomic concerns, saw Bitcoin fall below $55,000 again on Sunday after nearly touching $54,000 on Friday—the lowest it’s been since late February. This volatility underscores the complex interplay between staking trends, ETF anticipation, and broader market forces.

For now, the 24=7% staking milestone serves as a testament to the growing conviction among ETH holders that staking is the future. Whether that future includes ETFs directly, or whether it will be shaped by a new breed of staking-focused funds and companies, is still unclear. As the crypto world holds its breath for the SEC’s final decision, the stage is set for a potentially transformative moment in Ethereum’s history.

Edited by Stacy Elliott.

This milestone underscores the growing enthusiasm for Ethereum staking, even as the ecosystem grapples with the implications of the long-awaited Ethereum ETFs. The new exchange-traded funds, unlike their underlying asset, won’t be able to stake their holdings due to regulatory constraints.

The rise in staked ETH has been steady, with a brief slowdown following the Shanghai upgrade in spring 2023. As of this writing, Ethereum is trading just below $3,000, down 14% over the past week amid broader market volatility.

The SEC’s approval process for Ethereum ETFs has been slower than initially expected. Bloomberg ETF analyst James Seyffart noted on Twitter (aka X), “We’re thinking these things could potentially list later next week or the week of the 15th at this point.”

This comes after Bitwise filed an amended S-1 form ahead of the July 8 deadline, potentially indicating that the products are nearly ready for launch. VanEck then filed its own amended S-1 on Monday.

Evan Van Ness, a prominent Ethereum researcher, offered insights on the staking situation. “We definitely don’t need this much ETH staked, given how Ethereum proof-of-stake has so many times more economic security than proof-of-work,” he told Decrypt.

He also cautioned about centralization risks: “If your staking pool is running a majority client or runs in the cloud, you are putting your ETH at risk.”

The inability of ETFs to stake has spurred innovative approaches from traditional finance players. Franklin Templeton, managing $1.6 trillion in assets, is planning to launch a fund focused on altcoins and staking rewards, unnamed sources with knowledge of the firm told The Information.

Meanwhile, Toronto-based Purpose Investments already has an Ethereum fund that’s allowed to stake the underlying ETH.

“We’ve always been excited about Ethereum and what the technology and ecosystem represent,” he said in a press release. “Initially, a corporate structure was the best option; now we believe an ETF is the most efficient.”

The flurry of activity around Ethereum staking and ETFs raises questions about the future of the ecosystem, too. As more institutional players wade into staking waters and the percentage of staked ETH climbs, the Ethereum community will be watching closely to see how these developments impact the network’s security, decentralization, and overall health.

Danny Ryan, an Ethereum Foundation researcher, shared his thoughts on staking economics at the EthStaker Staking Gathering last year. “Staking on Ethereum is influenced by reward curves and overall economic incentives built into the protocol,” he said. “The goal is to create a sustainable and secure system that encourages participation and maintains the network’s integrity.”

The recent market downturn, attributed to factors such as the imminent Mt. Gox repayments and macroeconomic concerns, saw Bitcoin fall below $55,000 again on Sunday after nearly touching $54,000 on Friday—the lowest it’s been since late February. This volatility underscores the complex interplay between staking trends, ETF anticipation, and broader market forces.

For now, the 24=7% staking milestone serves as a testament to the growing conviction among ETH holders that staking is the future. Whether that future includes ETFs directly, or whether it will be shaped by a new breed of staking-focused funds and companies, is still unclear. As the crypto world holds its breath for the SEC’s final decision, the stage is set for a potentially transformative moment in Ethereum’s history.

Edited by Stacy Elliott.