Main Takeaways

This blog recaps the recent Binance Research report discussing key developments in crypto markets over the past month.

In June, the crypto market experienced a significant downward momentum, as high as 11.4% decline

In line with the market downturn, total DeFi TVL experienced an 8.7% decline in TVL in June. The NFT market experienced an extended downturn in June, recording a total sales volume of US$46M, a 26.2% decrease from May.

Thanks toBinance Research, you can take advantage of industry-grade analyses of the processes shaping Web3. By sharing these insights, we hope to empower our community with the latest knowledge from the field of crypto research.

Today’s blog explores key Web3 developments in June 2024 to provide an overview of the ecosystem’s current state. We analyze the performance of crypto, DeFi, and NFT markets before previewing major events to look out for in July 2024.

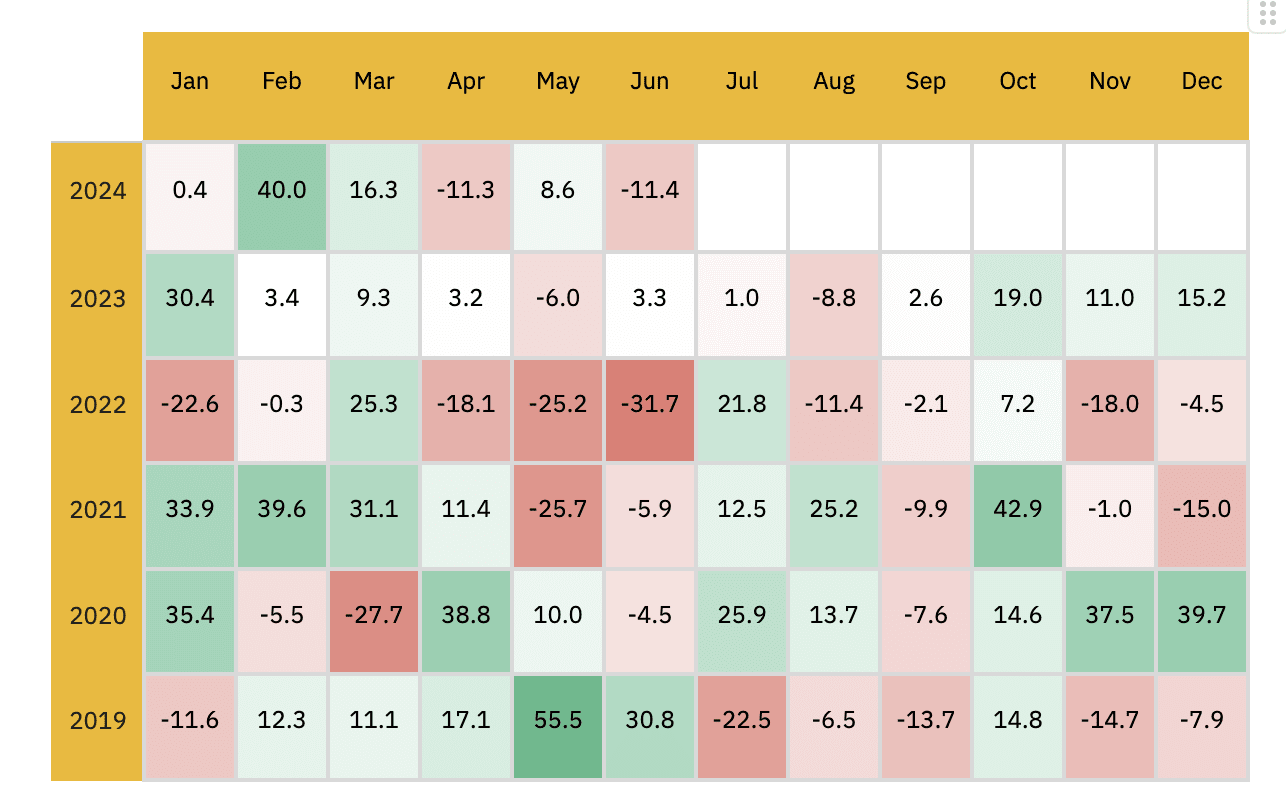

Crypto Market Performance in June 2024

Despite a strong start to the month of June, the market encountered major sell-offs and large-scale liquidation events driven by key factors. These include the impending Mt. Gox repayment distributions scheduled for July for over 140 000 BTC. Notably, the U.S. and German Governments were observed moving large amounts of BTC to centralized exchanges, adding on to the negative market sentiment. On a positive note, asset managers VanEck and ARK 21Shares filed for the first Solana ETFs in the U.S., providing optimism amidst the challenging market.

Monthly crypto market capitalization decreased by 11.4% in June

Source: CoinMarketCapAs of June 30, 2024

Source: CoinMarketCapAs of June 30, 2024

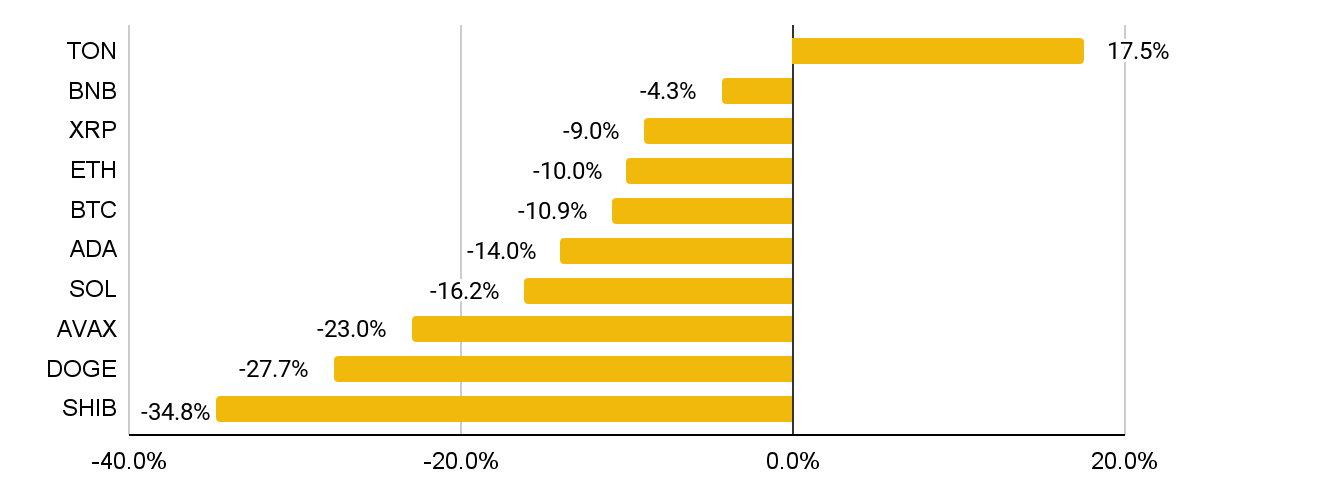

Monthly price performance of the top 10 coins by market capitalization

Source: CoinMarketCapAs of June 30, 2024

Amidst the market-wide sell-off, most of the top ten coins by market capitalization ended the month in the red. TON was the only one that significantly outperformed the market, hitting an all-time high (“ATH”) of US$8.24 and closing the month with a 17.5% gain. Additionally, TON’s DeFi TVL surged to US$700M, largely attributed to “The Open League,” a long-term incentive program for TON users, teams, and traders.

BNB retraced by 18.8%, closing the month in red. XRP experienced similar volatility, closing the month with a 9.0% decline. BTC experienced a 10.9% month-on-month (“MoM”) decline, largely influenced by the Mt. Gox’s announcement. ETH faced a 10.0% MoM decline in June, despite positive developments in SEC concluding investigation into Consensys and Ethereum 2.0, along with the progress of Ethereum ETF trading approval. Later in the month SEC launched another lawsuit against Consensys’s MetaMask and its staking platforms, Lido and Rocket Pool. ADA and SOL marked a 14.0% and 16.2% MoM decline respectively. However, towards the end of June, SOL exhibited a notable rally attributed to the introduction of the first spot Solana ETFs in the United States by digital asset managers VanEck and ARK 21Shares. AVAX recorded a significant decline of 23.0%, while SHIB and DOGE each retraced by 27.7% and 34.8%. Memecoins bore the initial brunt of the market downturn, underperforming the broader market.

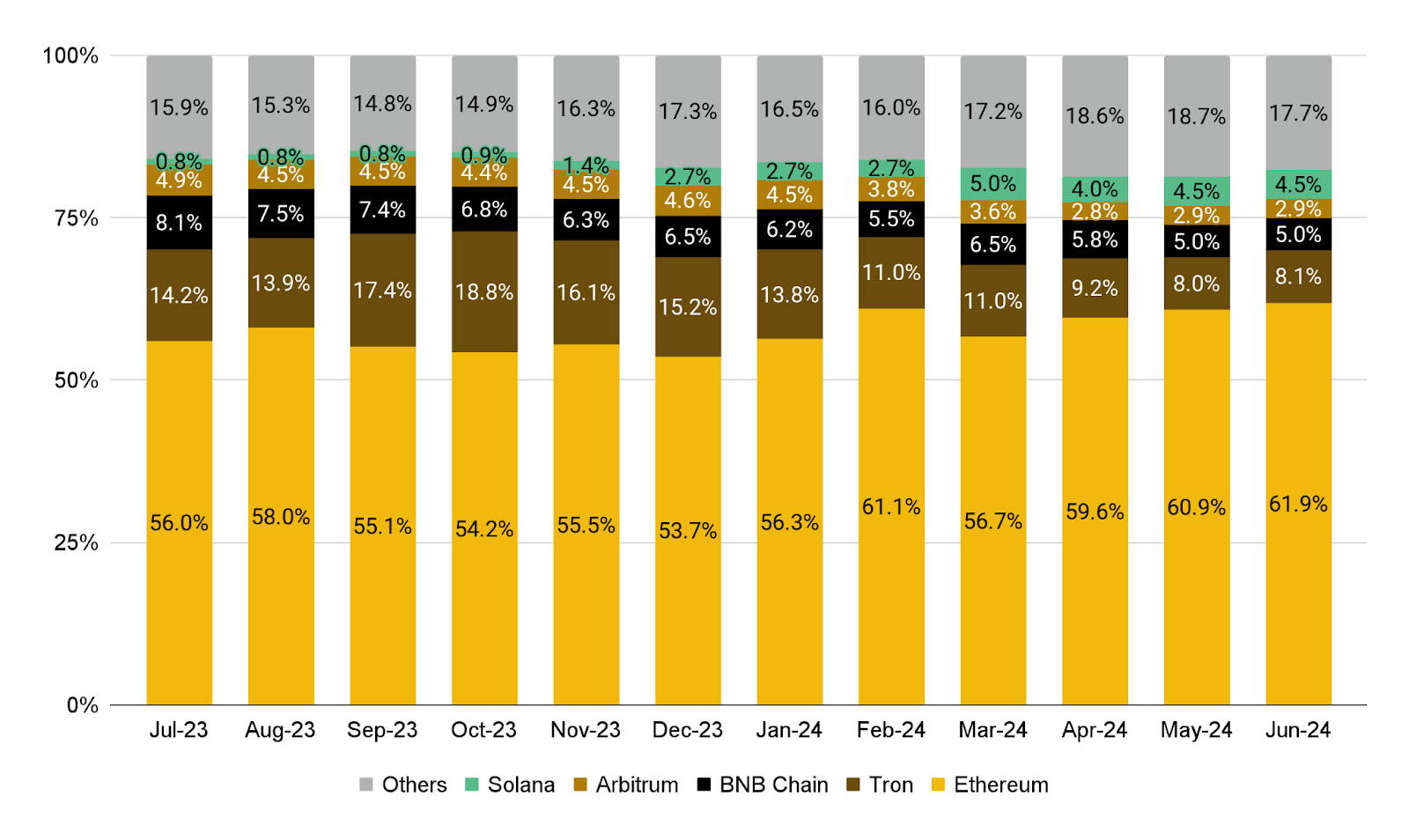

Decentralized Finance (DeFi)

In line with the market downturn, total DeFi TVL experienced an 8.7% decline in TVL in June. Notable gainers for the month include Bitcoin Layer-2 Networks Bsquared and CORE, which recorded impressive gains in TVL of 332% and 300% respectively. TON also continued its remarkable growth trajectory with a 109% month-on-month increase in TVL, hitting another all-time high of US$685.9M, thanks to “The Open League” successes. June saw the long-awaited release of airdrops and token generation events from several notable projects, including LayerZero, zkSync, Blast, and Eigenlayer (Phase 2).

TVL share of top blockchains

Source: DeFiLlamaAs of June 30, 2024

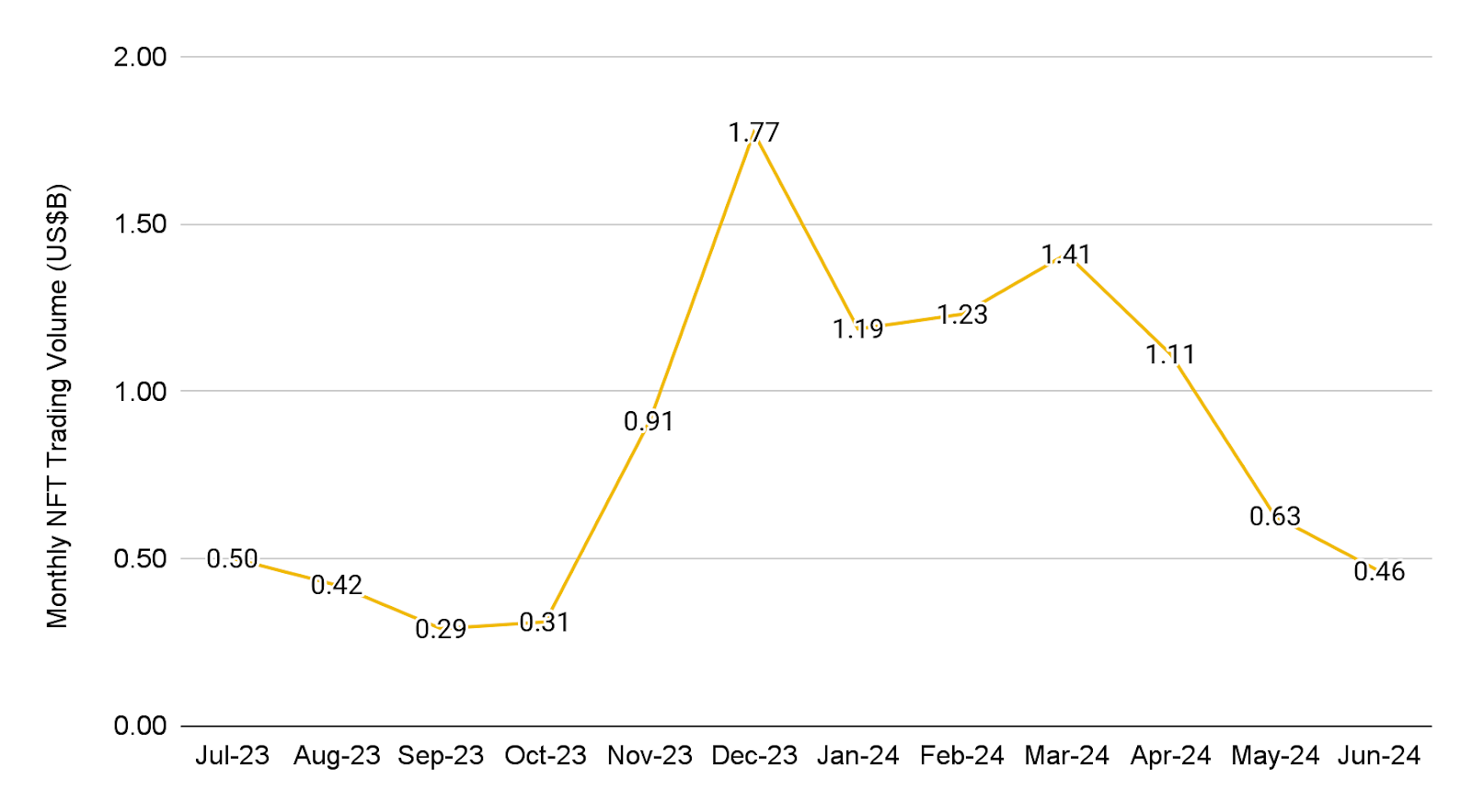

Non-Fungible Token (NFT)

Monthly NFT trading volume

Source: CryptoSlam As of June 30, 2024

The NFT market experienced a continued negative trend in June, recording a total sales volume of US$46M, a 26.2% decrease from May. DMarket, an in-game item marketplace on Mythos, led with the highest monthly sales volume at US$18.9M, followed closely by CryptoPunks with US$16.1M. Top Ordinal collections such as Bitcoin Puppets and NodeMonkes experienced a sharp decline in sales volume, sliding 40.6% and 41.0% respectively. Bored Ape Yacht Club saw a slight decrease in monthly sales volume, while Pudgy Penguins outperformed the market by recording a 68.9% upsurge.

Across the top chains, NFT sales volumes decreased considerably. Bitcoin and Ethereum saw a 48.2% and 50.2% downturn respectively, indicating the dwindling early hype over Bitcoin’s NFT. Solana’s monthly sales volume fell 40.9% and Blast faced a massive 81.0% plunge after the conclusion of its airdrop campaign.

Upcoming Events and Token Unlocks

To help users stay updated on the latest Web3 news, the Binance Research team has summarized notable events and token unlocks for the month to come. Keep an eye on these upcoming developments in the blockchain space.

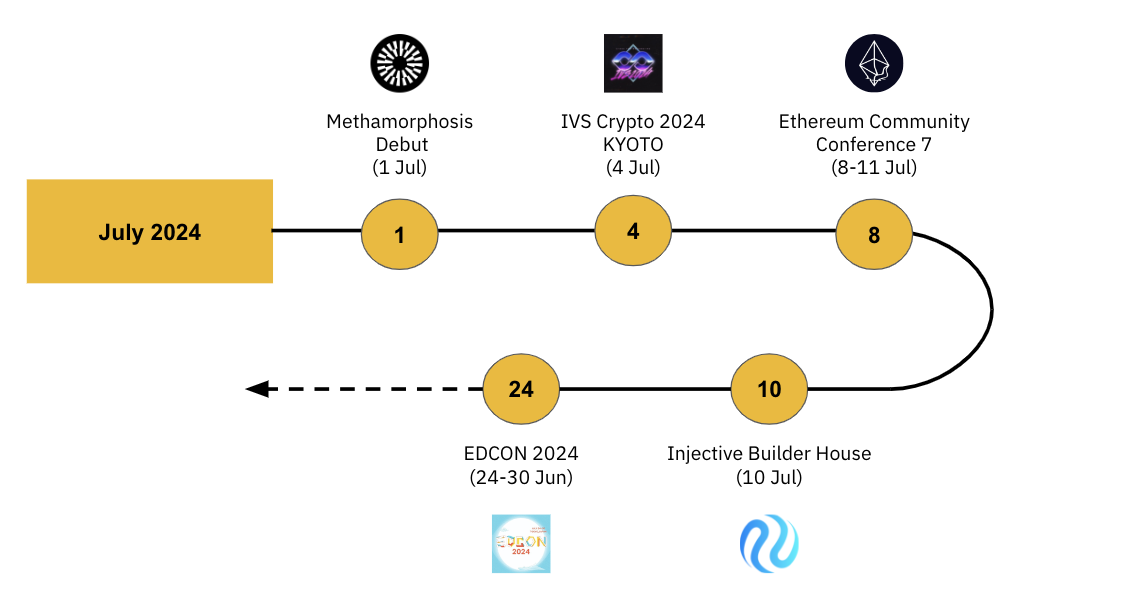

Notable Events in July 2024

Source: Binance Research, CoinMarketCap

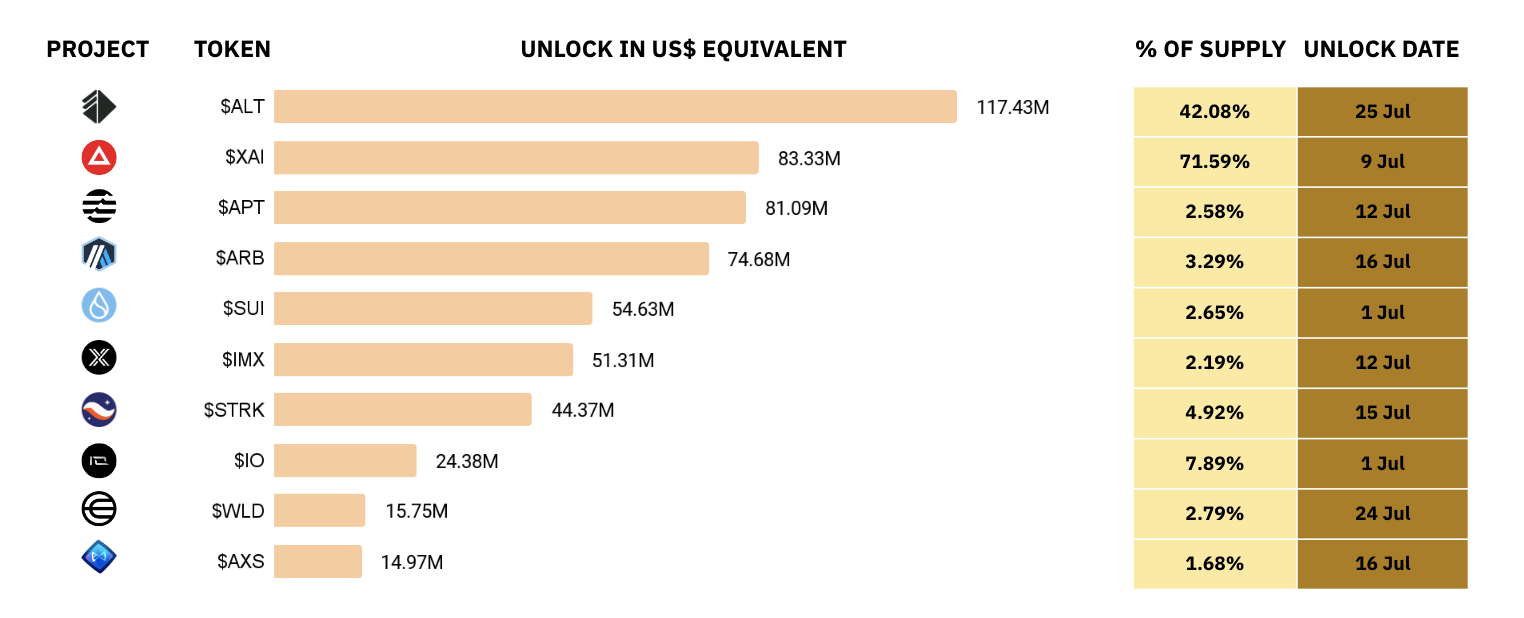

Largest token unlocks in US$ terms

Source: Token Unlocks, Binance Research

Binance Research

The Binance Research team is committed to delivering objective, independent, and comprehensive analyses of the crypto space. We publish insightful takes on Web3 topics, including but not limited to the crypto ecosystem, blockchain applications, and the latest market developments. This article is only a snapshot of the full report, which contains further analyses of the most important charts from the past month. The full report also looks into the trend of Bitcoin miners now consistently making up Bitcoin net sellers, especially after Bitcoin halving last April, TON’s record-breaking performance, BNB’s continued strength, and the emergence of competition in the staking landscape with new entrants such as Karak and Symbiotic challenging EigenLayer’s dominance.

Read the full version of this Binance Research report here.

Further Reading

Binance Research : Key Trends in Crypto – June 2024

Binance Research : Key Trends in Crypto – May 2024

Binance Research : Exploring the Landscape of Crypto Bots on Telegram

Disclaimer: This material is prepared by Binance Research and is not intended to be relied upon as a forecast or investment advice and is not a recommendation, offer, or solicitation to buy or sell any securities or cryptocurrencies or to adopt any investment strategy. The use of terminology and the views expressed are intended to promote understanding and the responsible development of the sector and should not be interpreted as definitive legal views or those of Binance. The opinions expressed are as of the date shown above and are the opinions of the writer; they may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Binance Research to be reliable, are not necessarily all-inclusive, and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given, and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Binance. This material may contain ‘forward-looking’ information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader. This material is intended for information purposes only and does not constitute investment advice or an offer or solicitation to purchase or sell in any securities, cryptocurrencies, or any investment strategy, nor shall any securities or cryptocurrency be offered or sold to any person in any jurisdiction in which an offer, solicitation, purchase, or sale would be unlawful under the laws of such jurisdiction. Investment involves risks.