This week, major news has captured the attention of crypto investors and enthusiasts alike. A potential spot Ethereum exchange-traded fund (ETF) approval, the upcoming US CPI data release, and other significant events are set to shape the crypto market.

These developments could have far-reaching implications, prompting market participants to stay vigilant and informed.

Major Crypto Legislation Faces Key Vote in Congress

This week, US lawmakers will vote on H.J. Res. 109, aiming to overturn the controversial SEC Staff Accounting Bulletin 121 (SAB 121). House Majority Leader Steve Scalise’s weekly schedule suggests that the resolution could be considered on Tuesday or Wednesday.

This bulletin requires financial institutions to list their customers’ digital assets on their balance sheets. Critics argue that this rule keeps digital assets outside the US financial system.

Both the House and Senate approved the repeal of SAB 121 in May. Still, President Joe Biden vetoed the bill, emphasizing his administration’s commitment to not supporting “measures that jeopardize the well-being of consumers and investors.” Many industry experts and investors believe this will be a crucial vote for the broader crypto industry.

Spot Ethereum ETF Approval on the Horizon

Market watchers are abuzz with expectations surrounding the potential approval of spot Ethereum (ETH) exchange-traded funds (ETFs). After several asset managers updated their S-1 forms, experts predict these ETFs could launch soon.

Bloomberg Intelligence’s ETF analysts, James Seyffart and Eric Balchunas, suggest that these ETFs “could potentially list later next week or the week of July 15.” Nate Geraci, president of ETF Store, echoes this sentiment.

“Will be shocked if spot ETH ETFs are not trading within the next 2 weeks. Later next week is a possibility, but I think the week of July 15 is more likely,” he noted.

The SEC’s approval process remains critical for these ETFs to commence trading. While the SEC has approved the 19b-4 forms, issuers still need their S-1 forms approved to proceed.

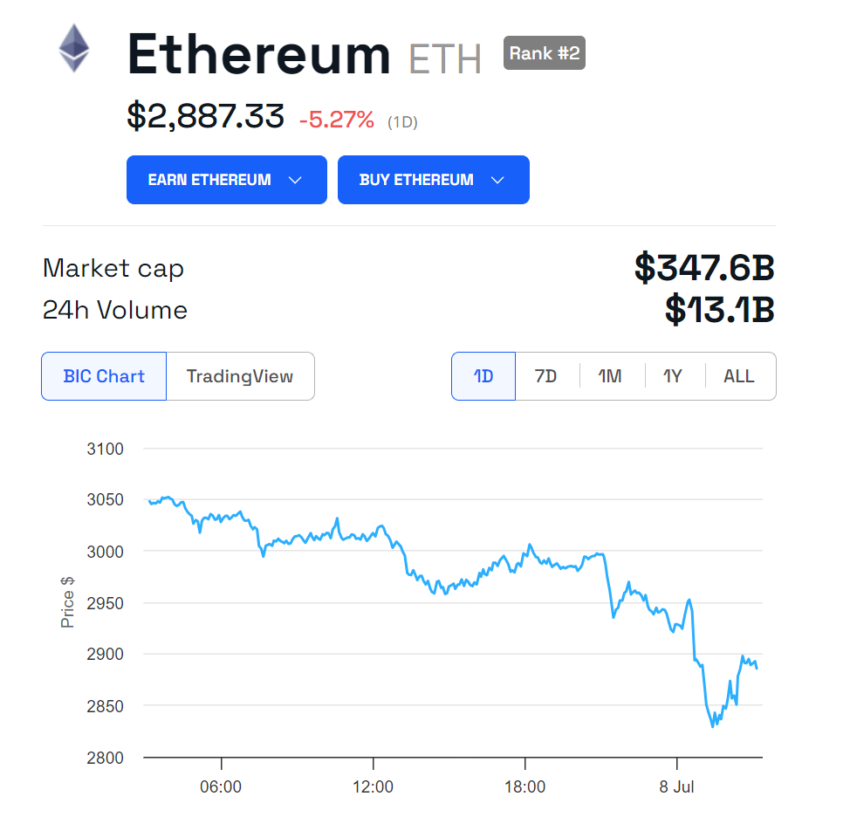

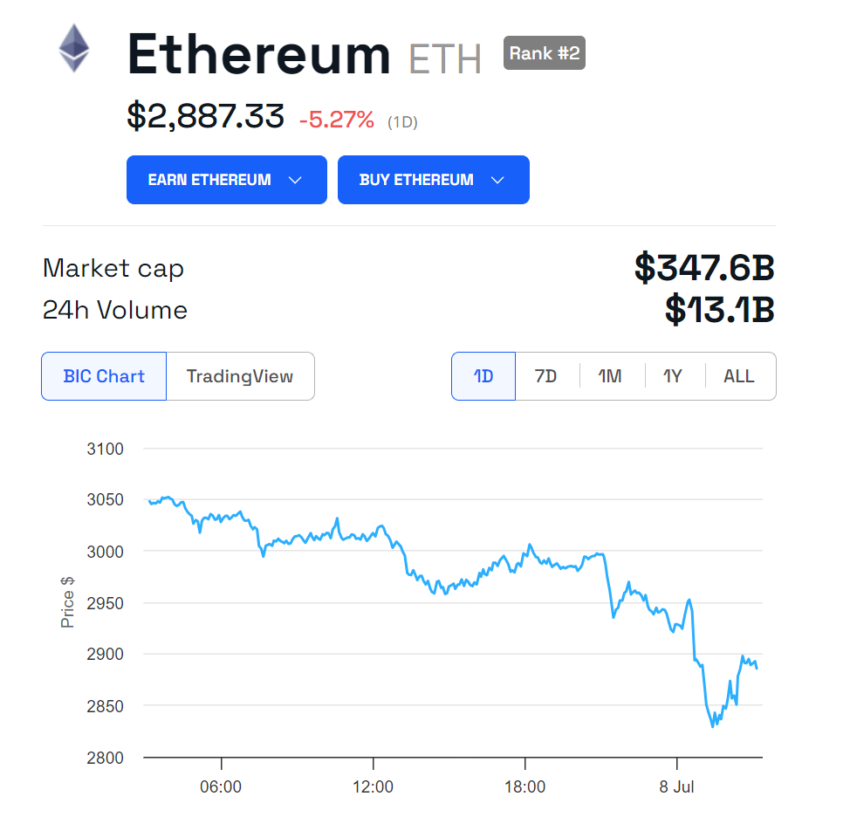

Despite the optimism surrounding the final approval of these ETFs, the price of ETH has decreased significantly since the approval of the 19b-4 forms in late May. According to BeInCrypto data, ETH is now trading at $2,865, marking a nearly 27% decrease since the preliminary approval date.

Read more: Ethereum ETF Explained: What It Is and How It Works

US CPI Data Release and Its Market Implications

Another critical event this week is the US Consumer Price Index (CPI) data, scheduled for release on July 11. The previous CPI data for May showed no month-to-month increase, which offers some respite to inflation concerns.

Projections from the Federal Reserve Bank of Cleveland suggest that the monthly increase in headline CPI inflation for June will be 0.08%, with core CPI inflation, excluding food and energy, at 0.28%. Although these estimates are not always precise, they are generally accurate in indicating where monthly inflation figures might land.

Nonetheless, the Federal Reserve will closely monitor the upcoming figures to gauge inflation trends and make informed policy decisions. This data will be considered at the central bank’s next policy meeting on July 30-31.

Lower inflation figures could indicate economic stability, potentially boosting investor confidence and driving capital into riskier assets like cryptocurrencies. Conversely, if inflation exceeds expectations, the Federal Reserve may opt to hold or raise interest rates, injecting uncertainty into the markets.

Due to their volatile nature, cryptocurrencies could undergo significant price changes in reaction to these economic indicators. Thus, investors should actively monitor CPI data and the Fed’s decisions to navigate the market.

Jupiter’s Supply Reduction Proposal

Jupiter, a Solana-based decentralized exchange (DEX), is set to implement a significant change in its tokenomics with a proposal to reduce the total supply of its native token, JUP, by 30%. This proposal, shared by the pseudonymous co-founder Meow, includes a voluntary team cut of 30% from their allocated tokens and a corresponding reduction in Jupuary emissions. The governance vote on this proposal will occur somewhere in July.

Meow emphasized that these changes are possible because Jupiter does not have direct investors, allowing the team to make bold moves to optimize the platform’s tokenomics. The proposed changes aim to address high emissions levels, streamline the platform’s financial structure, and engage the community more deeply in Jupiter’s long-term vision.

Vela V2 Launch and Upgrades

Vela, an Arbitrum-native perpetual DEX, will launch its Vela V2 on July 8. This version brings upgraded tokenomics, a new trading competition, and enhanced features to the platform.

Vela V2 includes flexible vesting options, governance voting, and a simplified staking page. Additionally, to incentivize participation and reward active users, Vela V2 will introduce a 500,000 ARB prize pool in Grand Prix Season 3.

Xai and Other Major Token Unlocks This Week

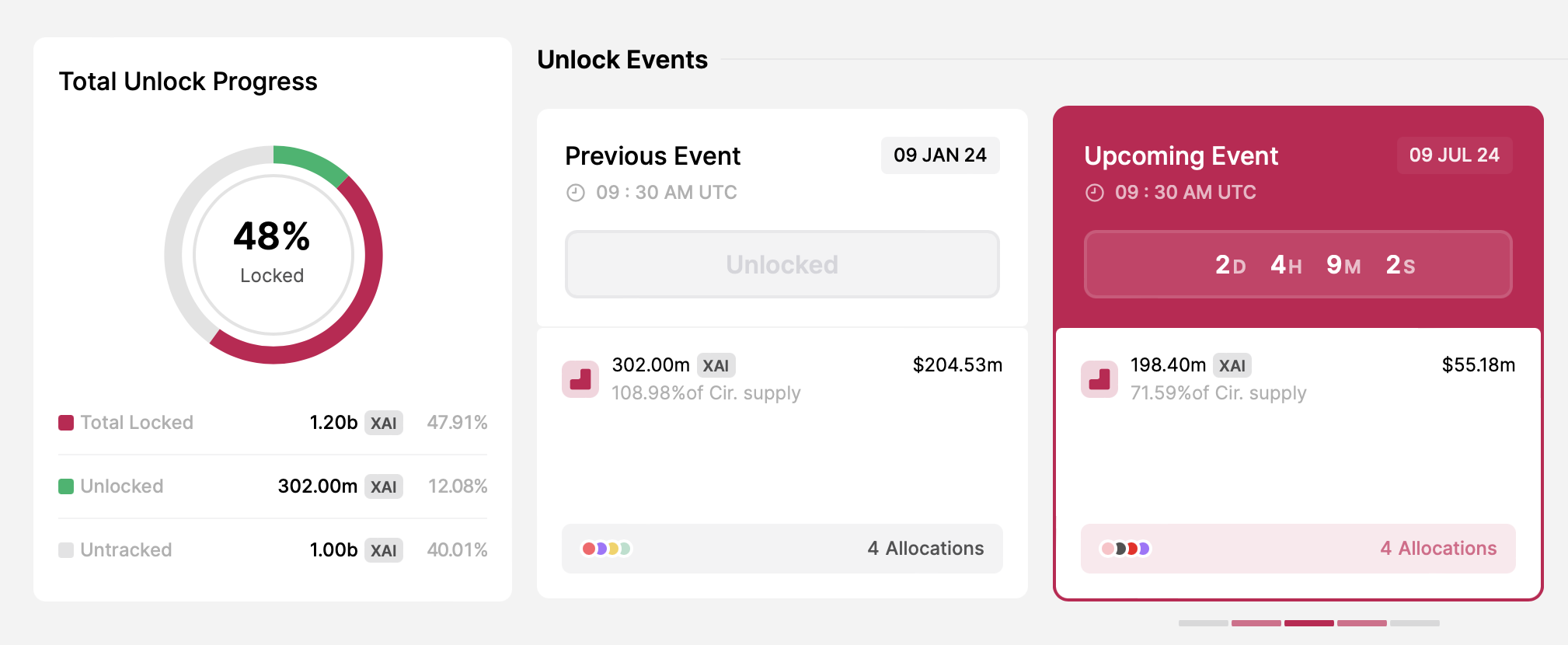

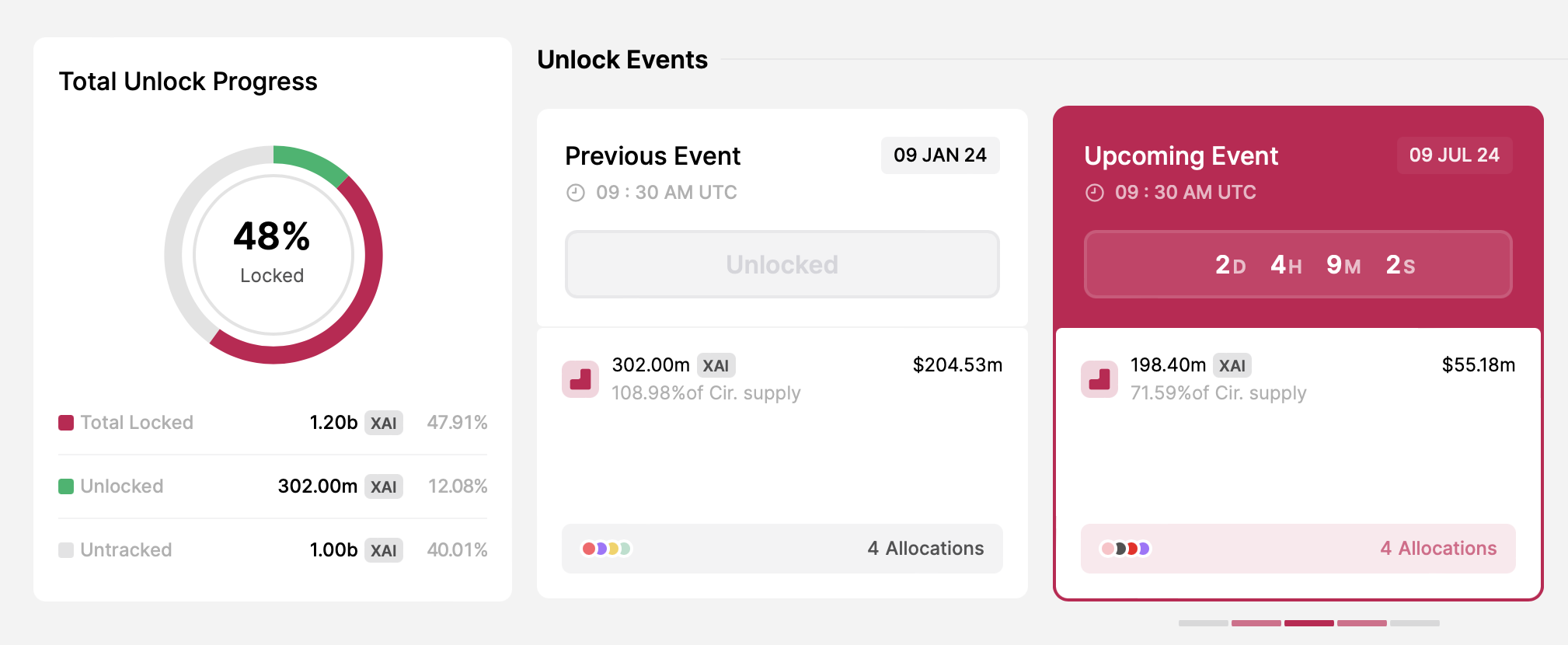

Xai, a layer-3 (L3) solution designed for AAA gaming, will unlock nearly 200 million XAI tokens on July 9. The amount, worth around $55.18 million, accounts for 71.59% of its circulating supply. Therefore, this token unlock has sparked discussions among the crypto community about its potential impact on XAI’s price.

Additionally, Aptos will unlock a significant amount of its native token, APT. TokenUnlocks data shows that the layer-1 (L1) blockchain will distribute 11.3 million APT among community members, core contributors, and investors on July 12. This figure represents 2.49% of its circulating supply, valued at approximately $62.88 million based on the current market price.

Other projects like Immutable (IMX) will also hold token unlocks over the same period. Read this article for further detailed information on major crypto token unlocks this week.

This week, major news has captured the attention of crypto investors and enthusiasts alike. A potential spot Ethereum exchange-traded fund (ETF) approval, the upcoming US CPI data release, and other significant events are set to shape the crypto market.

These developments could have far-reaching implications, prompting market participants to stay vigilant and informed.

Major Crypto Legislation Faces Key Vote in Congress

This week, US lawmakers will vote on H.J. Res. 109, aiming to overturn the controversial SEC Staff Accounting Bulletin 121 (SAB 121). House Majority Leader Steve Scalise’s weekly schedule suggests that the resolution could be considered on Tuesday or Wednesday.

This bulletin requires financial institutions to list their customers’ digital assets on their balance sheets. Critics argue that this rule keeps digital assets outside the US financial system.

Both the House and Senate approved the repeal of SAB 121 in May. Still, President Joe Biden vetoed the bill, emphasizing his administration’s commitment to not supporting “measures that jeopardize the well-being of consumers and investors.” Many industry experts and investors believe this will be a crucial vote for the broader crypto industry.

Spot Ethereum ETF Approval on the Horizon

Market watchers are abuzz with expectations surrounding the potential approval of spot Ethereum (ETH) exchange-traded funds (ETFs). After several asset managers updated their S-1 forms, experts predict these ETFs could launch soon.

Bloomberg Intelligence’s ETF analysts, James Seyffart and Eric Balchunas, suggest that these ETFs “could potentially list later next week or the week of July 15.” Nate Geraci, president of ETF Store, echoes this sentiment.

“Will be shocked if spot ETH ETFs are not trading within the next 2 weeks. Later next week is a possibility, but I think the week of July 15 is more likely,” he noted.

The SEC’s approval process remains critical for these ETFs to commence trading. While the SEC has approved the 19b-4 forms, issuers still need their S-1 forms approved to proceed.

Despite the optimism surrounding the final approval of these ETFs, the price of ETH has decreased significantly since the approval of the 19b-4 forms in late May. According to BeInCrypto data, ETH is now trading at $2,865, marking a nearly 27% decrease since the preliminary approval date.

Read more: Ethereum ETF Explained: What It Is and How It Works

US CPI Data Release and Its Market Implications

Another critical event this week is the US Consumer Price Index (CPI) data, scheduled for release on July 11. The previous CPI data for May showed no month-to-month increase, which offers some respite to inflation concerns.

Projections from the Federal Reserve Bank of Cleveland suggest that the monthly increase in headline CPI inflation for June will be 0.08%, with core CPI inflation, excluding food and energy, at 0.28%. Although these estimates are not always precise, they are generally accurate in indicating where monthly inflation figures might land.

Nonetheless, the Federal Reserve will closely monitor the upcoming figures to gauge inflation trends and make informed policy decisions. This data will be considered at the central bank’s next policy meeting on July 30-31.

Lower inflation figures could indicate economic stability, potentially boosting investor confidence and driving capital into riskier assets like cryptocurrencies. Conversely, if inflation exceeds expectations, the Federal Reserve may opt to hold or raise interest rates, injecting uncertainty into the markets.

Due to their volatile nature, cryptocurrencies could undergo significant price changes in reaction to these economic indicators. Thus, investors should actively monitor CPI data and the Fed’s decisions to navigate the market.

Jupiter’s Supply Reduction Proposal

Jupiter, a Solana-based decentralized exchange (DEX), is set to implement a significant change in its tokenomics with a proposal to reduce the total supply of its native token, JUP, by 30%. This proposal, shared by the pseudonymous co-founder Meow, includes a voluntary team cut of 30% from their allocated tokens and a corresponding reduction in Jupuary emissions. The governance vote on this proposal will occur somewhere in July.

Meow emphasized that these changes are possible because Jupiter does not have direct investors, allowing the team to make bold moves to optimize the platform’s tokenomics. The proposed changes aim to address high emissions levels, streamline the platform’s financial structure, and engage the community more deeply in Jupiter’s long-term vision.

Vela V2 Launch and Upgrades

Vela, an Arbitrum-native perpetual DEX, will launch its Vela V2 on July 8. This version brings upgraded tokenomics, a new trading competition, and enhanced features to the platform.

Vela V2 includes flexible vesting options, governance voting, and a simplified staking page. Additionally, to incentivize participation and reward active users, Vela V2 will introduce a 500,000 ARB prize pool in Grand Prix Season 3.

Xai and Other Major Token Unlocks This Week

Xai, a layer-3 (L3) solution designed for AAA gaming, will unlock nearly 200 million XAI tokens on July 9. The amount, worth around $55.18 million, accounts for 71.59% of its circulating supply. Therefore, this token unlock has sparked discussions among the crypto community about its potential impact on XAI’s price.

Additionally, Aptos will unlock a significant amount of its native token, APT. TokenUnlocks data shows that the layer-1 (L1) blockchain will distribute 11.3 million APT among community members, core contributors, and investors on July 12. This figure represents 2.49% of its circulating supply, valued at approximately $62.88 million based on the current market price.

Other projects like Immutable (IMX) will also hold token unlocks over the same period. Read this article for further detailed information on major crypto token unlocks this week.