Franklin Templeton, a veteran wealth manager with over $1.65 trillion in AUM, shares its bullish take on Ethereum (ETH) as a tech development and economic instrument. Despite savage competition, Ethereum (ETH) remains the backbone of decentralized economy and constantly unlocks new opportunities for the community.

“Forefront of Web3 innovation”: Franklin Templeton praises Ethereum

Global asset management heavyweight Franklin Templeton released its “Understanding the Value of The Ethereum Network” report covering the tech impact of the second cryptocurrency. It displays the most important features of the Ethereum (ETH) blockchain, its challenges and opportunities.

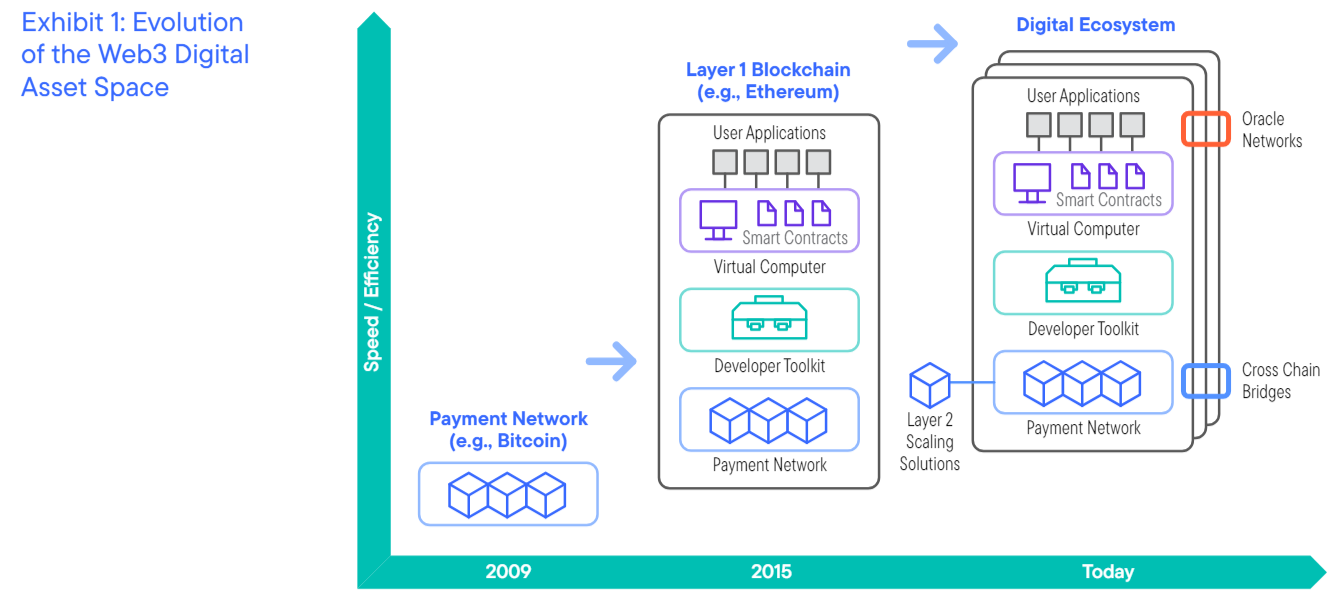

The analysts of the investment giant stressed that Ethereum advanced Bitcoin’s accomplishments to create a robust and accessible tech basis for distributed ledger applications, enabling a comprehensive decentralized economy.

As the next step, the onset of the Ethereum Virtual Machine (EVM) and its Solidity smart contracts has changed the narrative in app development, making Ethereum the foundation for a wide range of decentralized applications across various segments in B2B and B2C.

The report particularly highlights the scaling role of Layer 2 networks in pushing the barriers of Ethereum (ETH) performance metrics and decentralization status:

Collectively, L1 blockchains (Ethereum and others) and L2 blockchains provide the foundations for “Web3,” the new iteration of the World Wide Web (WWW) that enables users’ WWW ownership. The Web3 business models that have emerged are paving the way for a new type of network economy and approach to commercial transactions, creating a protocol-based economy that encourages democratized ownership and rewards participation

As a result, Ethereum (ETH) managed to establish a vibrant, diversified protocol economy with a diverse array of novel use cases in DeFi, GameFi, NFT, metaverse and other trending segments.

Ethereum ETFs: Final call?

Authors concluded that Ethereum (ETH) stands out as unique combination of a native peer-to-peer payment network, a common developer toolkit and a virtual machine for executing smart contracts that has set a new standard for blockchain technology.

It should be added that Franklin Templeton is a participant of the Ethereum spot ETF race in the U.S. It filed with the SEC for an ETF approval in February 2024.

As covered by U.Today previously, major analysts and community participants are sure that Ethereum spot ETFs will be green-lit as soon as this month.

The final approval of S-1 forms is expected to happen by July 12, said The ETF Store president Nate Geraci. Potentially, this hints at ETF trading launch following on July 15.