Key Points:

- Solana’s liquid staking saw substantial growth.

- Sanctum helped diversify the market.

- jupSOL from Jupiter Exchange now holds the highest APY.

Solana liquid staking grew significantly, with a 1.76% quarterly increase and a more diversified market. Sanctum’s initiatives and jupSOL’s rise contributed greatly.

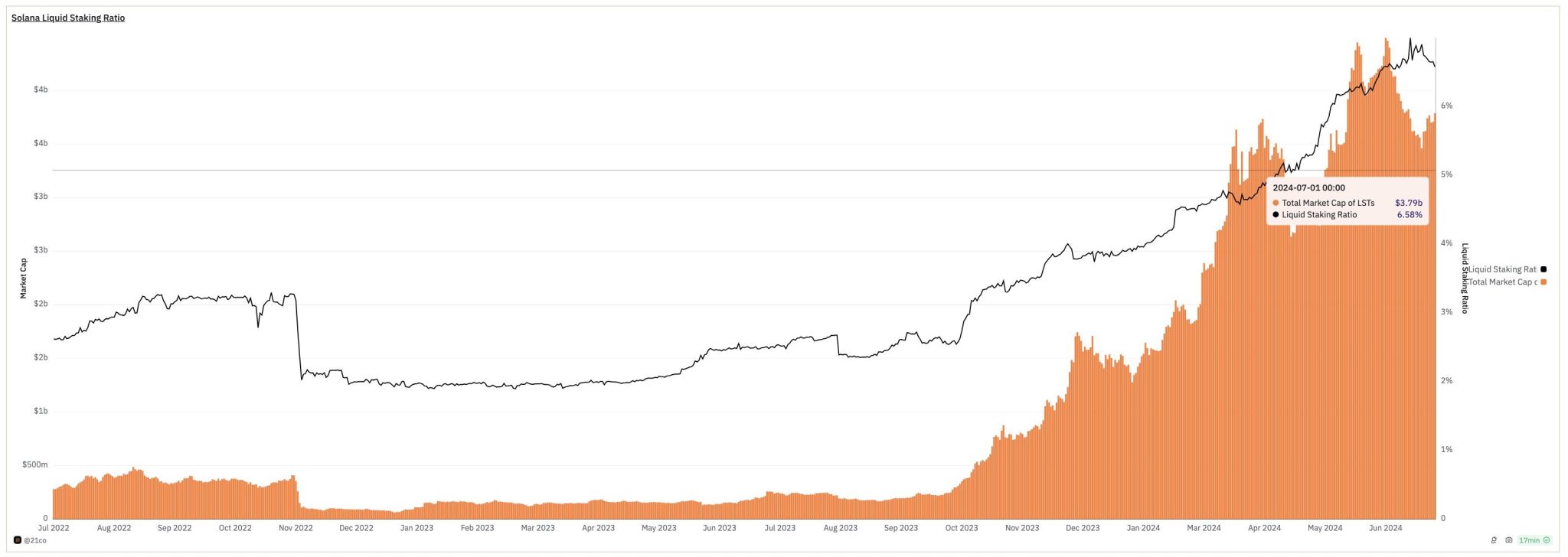

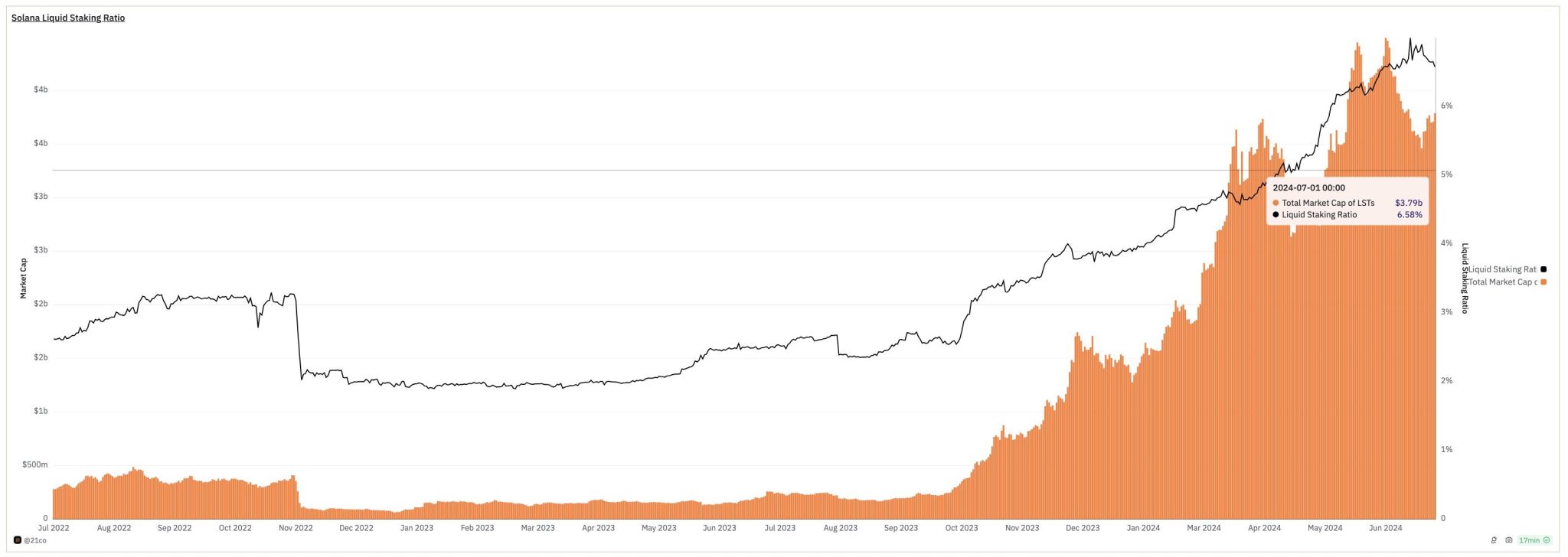

Analyst Tom Wan reported that Solana’s liquid staking saw incredible growth, with key indicators such as a quarterly 1.76% increase in the Liquid Staking Ratio and a doubling of Liquid Staking Tokens.

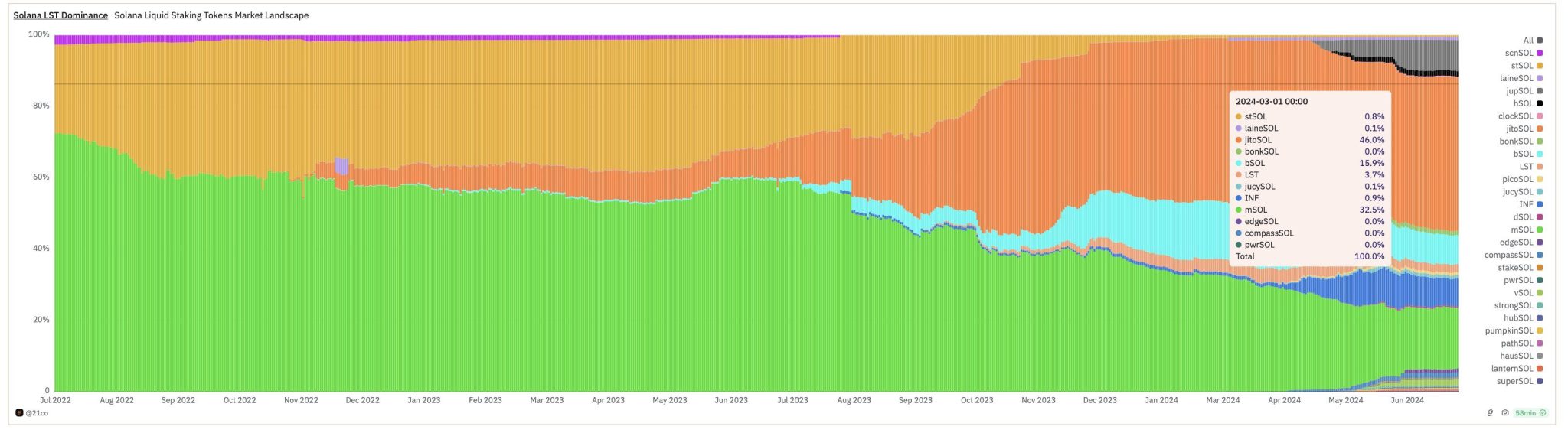

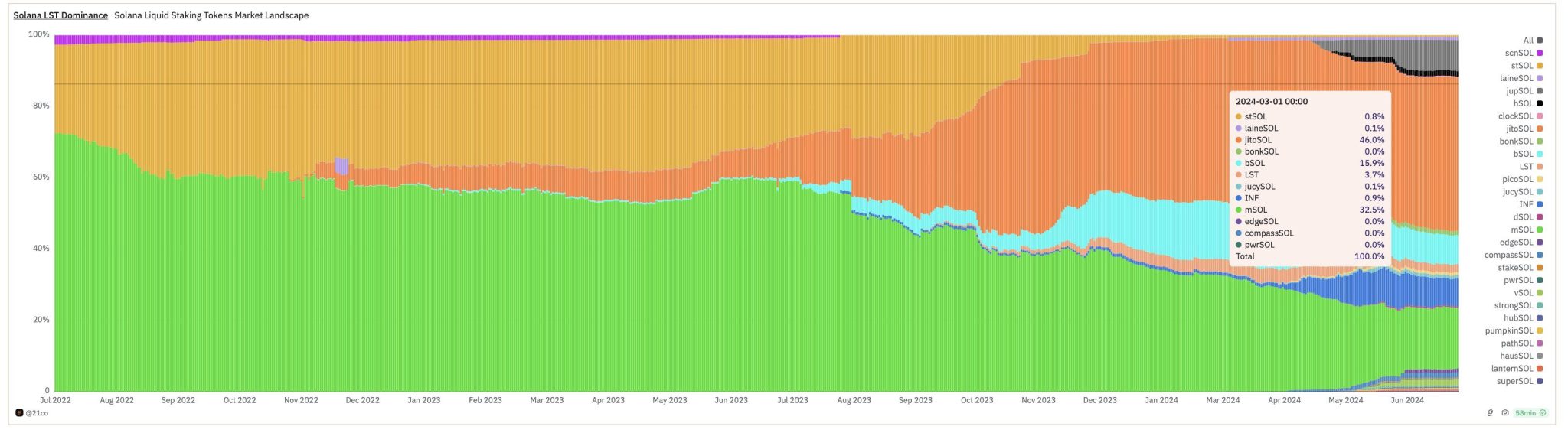

In addition, further diversification is down the line from a contribution of 93% to 68.7% in market share by the top three providers.

Solana Liquid Staking Experiences Remarkable Growth

As one of the major players in this arena, Sanctum has contributed much to that shift. On Solana, an airdrop from Jito Labs drew attention to the potential of liquid staking, which made the thing emerge, wherein the ratio of liquid staking grew by 2% from Q4 2023 to Q1 2024.

Initiatives launched by Sanctum, INF, Sanctum Router, and Sanctum Reserve provided low entry barriers and created conditions for expansion in Solana’s liquid staking.

The number of LSTs listed on Solana is now 53, approximately doubling from the previous quarter. Thanks to Sanctum Router and Reserve, users willing to experiment with new LSTs feel no discomfort about sufficient liquidity. This can let newer LSTs like vSOL, edgeSOL, or jupSOL proliferate.

Readmore: Ethereum ETF Approval Timeline Remains Uncertain

Jupiter Exchange’s jupSOL Emerges as a Top Performer in the Market

According to Tom Wan, 70% of the Liquid Staking Sector is dominated by a single player, Lido. However, with Sanctum’s assistance, high-quality projects like Helius Labs, Solana Compass, Jupiter Exchange, and Drift Protocol can efficiently challenge the status quo and create their own LSTs. The top three LSTs hold only 68% of the market share, indicating a more balanced and diversified market.

Jupiter Exchange’s jupSOL has surged into the top three LSTs, outperforming bSOL with a Total Value of $329M. The integration with Kamino Finance pushed jupSOL to 22% growth in the last 30 days.

Deposition of 59% of its $220M on Kamino also enables jupSOL to have the highest APY at 21%, further increasing its hold on the market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Key Points:

- Solana’s liquid staking saw substantial growth.

- Sanctum helped diversify the market.

- jupSOL from Jupiter Exchange now holds the highest APY.

Solana liquid staking grew significantly, with a 1.76% quarterly increase and a more diversified market. Sanctum’s initiatives and jupSOL’s rise contributed greatly.

Analyst Tom Wan reported that Solana’s liquid staking saw incredible growth, with key indicators such as a quarterly 1.76% increase in the Liquid Staking Ratio and a doubling of Liquid Staking Tokens.

In addition, further diversification is down the line from a contribution of 93% to 68.7% in market share by the top three providers.

Solana Liquid Staking Experiences Remarkable Growth

As one of the major players in this arena, Sanctum has contributed much to that shift. On Solana, an airdrop from Jito Labs drew attention to the potential of liquid staking, which made the thing emerge, wherein the ratio of liquid staking grew by 2% from Q4 2023 to Q1 2024.

Initiatives launched by Sanctum, INF, Sanctum Router, and Sanctum Reserve provided low entry barriers and created conditions for expansion in Solana’s liquid staking.

The number of LSTs listed on Solana is now 53, approximately doubling from the previous quarter. Thanks to Sanctum Router and Reserve, users willing to experiment with new LSTs feel no discomfort about sufficient liquidity. This can let newer LSTs like vSOL, edgeSOL, or jupSOL proliferate.

Readmore: Ethereum ETF Approval Timeline Remains Uncertain

Jupiter Exchange’s jupSOL Emerges as a Top Performer in the Market

According to Tom Wan, 70% of the Liquid Staking Sector is dominated by a single player, Lido. However, with Sanctum’s assistance, high-quality projects like Helius Labs, Solana Compass, Jupiter Exchange, and Drift Protocol can efficiently challenge the status quo and create their own LSTs. The top three LSTs hold only 68% of the market share, indicating a more balanced and diversified market.

Jupiter Exchange’s jupSOL has surged into the top three LSTs, outperforming bSOL with a Total Value of $329M. The integration with Kamino Finance pushed jupSOL to 22% growth in the last 30 days.

Deposition of 59% of its $220M on Kamino also enables jupSOL to have the highest APY at 21%, further increasing its hold on the market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |