The uptick in meme market activity in the last week has led to a rally in Dogecoin’s (DOGE) value. Trading at $0.12 at press time, the leading meme coin has witnessed a 6% price hike in the past seven days.

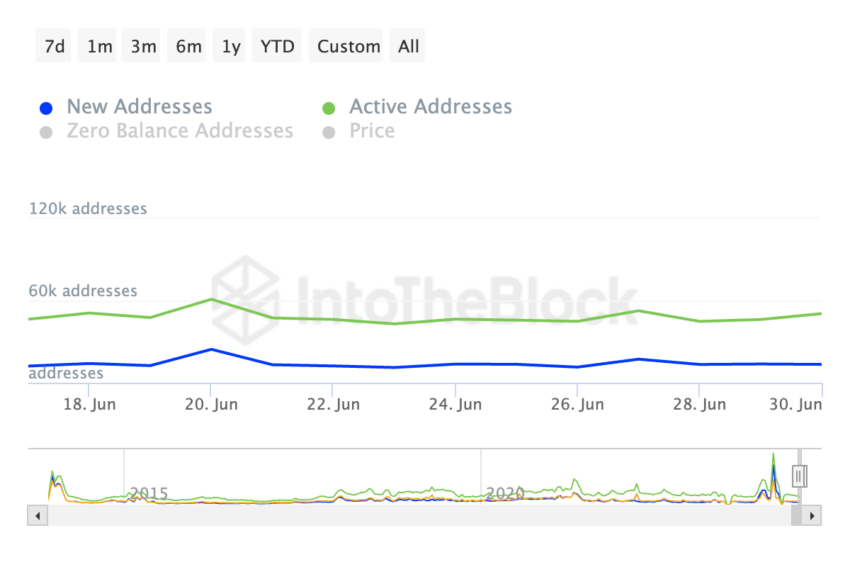

During that period, the daily count of addresses involved in DOGE transactions and the number of new addresses created to trade the meme coin have risen.

Dogecoin Witnesses Growth in Network Activity

The week under review has been marked by increased traders’ demand for Dogecoin. In the past seven days, the number of addresses involved in daily DOGE transactions has risen by 20%.

Likewise, the new demand for the meme coin has also spiked. During the same period, the daily count of new addresses created to trade DOGE has gone up 17%.

When an asset sees an uptick in daily active and new addresses, it means more traders are trading it. Generally, increased network activity is often seen as an indicator of positive market sentiment and potential for future growth.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

The growth in DOGE’s demand in the last week may be due to the buying opportunity presented by the month-long dip in the coin’s value. DOGE has witnessed a 20% decline in the past 30 days.

Dogecoin Presents Buying Opportunity Based on MVRV Ratio

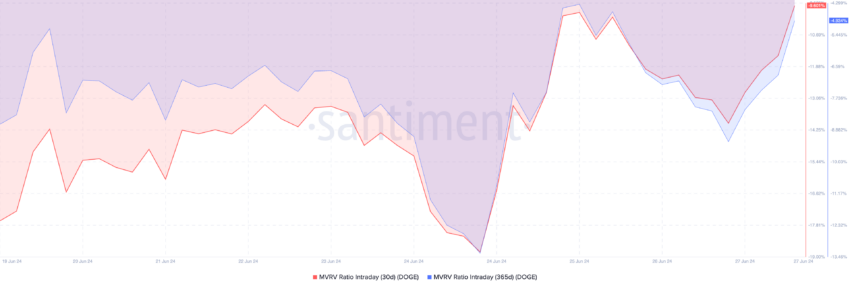

Readings from its Market Value to Realized Value (MVRV) ratio confirm that now may be a good time to buy the meme coin.

DOGE’s MVRV ratios, based on 30-day and 365-day moving averages, are -9.6% and -4.93%, respectively, at the time of writing.

This metric tracks the ratio between an asset’s current market price and the average price of all its coins or tokens in circulation.

When its value is positive, the asset’s current market value is higher than the price at which most investors acquired their holdings. The asset is said to be overvalued.

Conversely, a negative MVRV value shows that the asset is undervalued. It suggests that the market value of the asset in question is below the average purchase price of all its tokens that are in circulation.

A negative MVRV ratio is interpreted as a buy signal because it means that the asset trades at a price lower than its historical cost basis.

DOGE Price Prediction: Leading Meme Coin Makes its Move

The recent rally in DOGE’s value has pushed its price toward its 20-day exponential moving average (EMA). Observed on a daily chart, the meme coin’s price is gearing to cross above this key moving average.

An asset’s 20-day EMA tracks its average price over the past 20 trading days. When an asset’s price is preparing to cross above its 20-day EMA, it indicates a potential bullish trend.

This means the asset’s recent price momentum is strong enough to surpass its average price over the past 20 days. It suggests increased buying interest among market participants, which traders often interpret as a signal for future price gains.

If this trend continues, DOGE’s price will surge to $0.13. However, if this is invalidated, its value may drop to $0.12.

The uptick in meme market activity in the last week has led to a rally in Dogecoin’s (DOGE) value. Trading at $0.12 at press time, the leading meme coin has witnessed a 6% price hike in the past seven days.

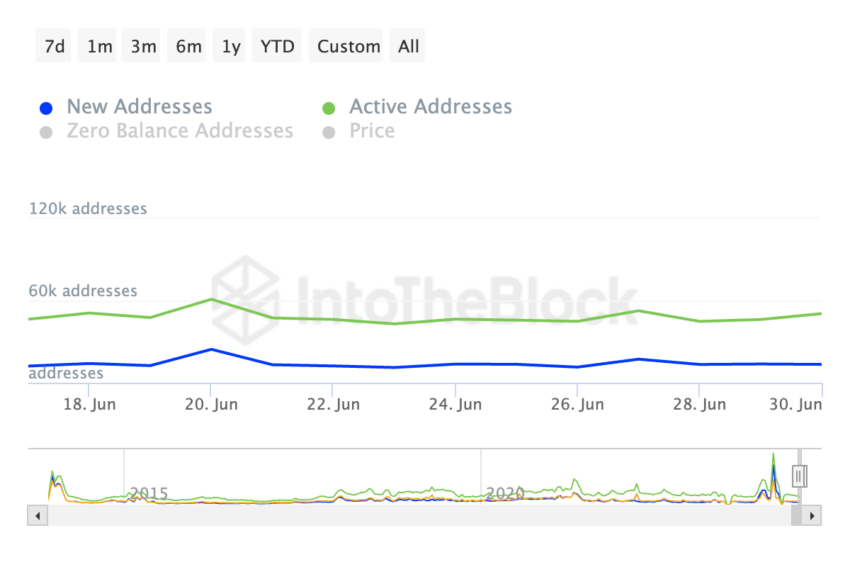

During that period, the daily count of addresses involved in DOGE transactions and the number of new addresses created to trade the meme coin have risen.

Dogecoin Witnesses Growth in Network Activity

The week under review has been marked by increased traders’ demand for Dogecoin. In the past seven days, the number of addresses involved in daily DOGE transactions has risen by 20%.

Likewise, the new demand for the meme coin has also spiked. During the same period, the daily count of new addresses created to trade DOGE has gone up 17%.

When an asset sees an uptick in daily active and new addresses, it means more traders are trading it. Generally, increased network activity is often seen as an indicator of positive market sentiment and potential for future growth.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

The growth in DOGE’s demand in the last week may be due to the buying opportunity presented by the month-long dip in the coin’s value. DOGE has witnessed a 20% decline in the past 30 days.

Dogecoin Presents Buying Opportunity Based on MVRV Ratio

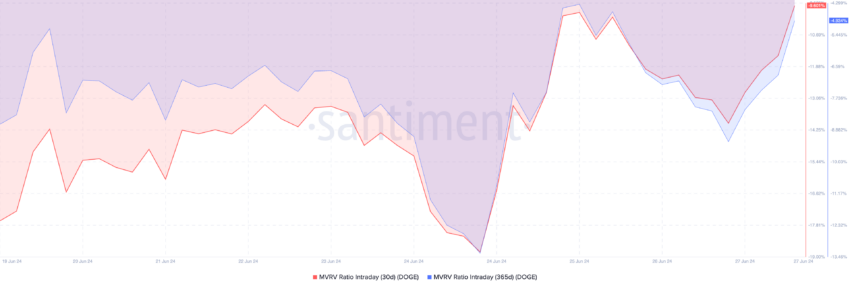

Readings from its Market Value to Realized Value (MVRV) ratio confirm that now may be a good time to buy the meme coin.

DOGE’s MVRV ratios, based on 30-day and 365-day moving averages, are -9.6% and -4.93%, respectively, at the time of writing.

This metric tracks the ratio between an asset’s current market price and the average price of all its coins or tokens in circulation.

When its value is positive, the asset’s current market value is higher than the price at which most investors acquired their holdings. The asset is said to be overvalued.

Conversely, a negative MVRV value shows that the asset is undervalued. It suggests that the market value of the asset in question is below the average purchase price of all its tokens that are in circulation.

A negative MVRV ratio is interpreted as a buy signal because it means that the asset trades at a price lower than its historical cost basis.

DOGE Price Prediction: Leading Meme Coin Makes its Move

The recent rally in DOGE’s value has pushed its price toward its 20-day exponential moving average (EMA). Observed on a daily chart, the meme coin’s price is gearing to cross above this key moving average.

An asset’s 20-day EMA tracks its average price over the past 20 trading days. When an asset’s price is preparing to cross above its 20-day EMA, it indicates a potential bullish trend.

This means the asset’s recent price momentum is strong enough to surpass its average price over the past 20 days. It suggests increased buying interest among market participants, which traders often interpret as a signal for future price gains.

If this trend continues, DOGE’s price will surge to $0.13. However, if this is invalidated, its value may drop to $0.12.