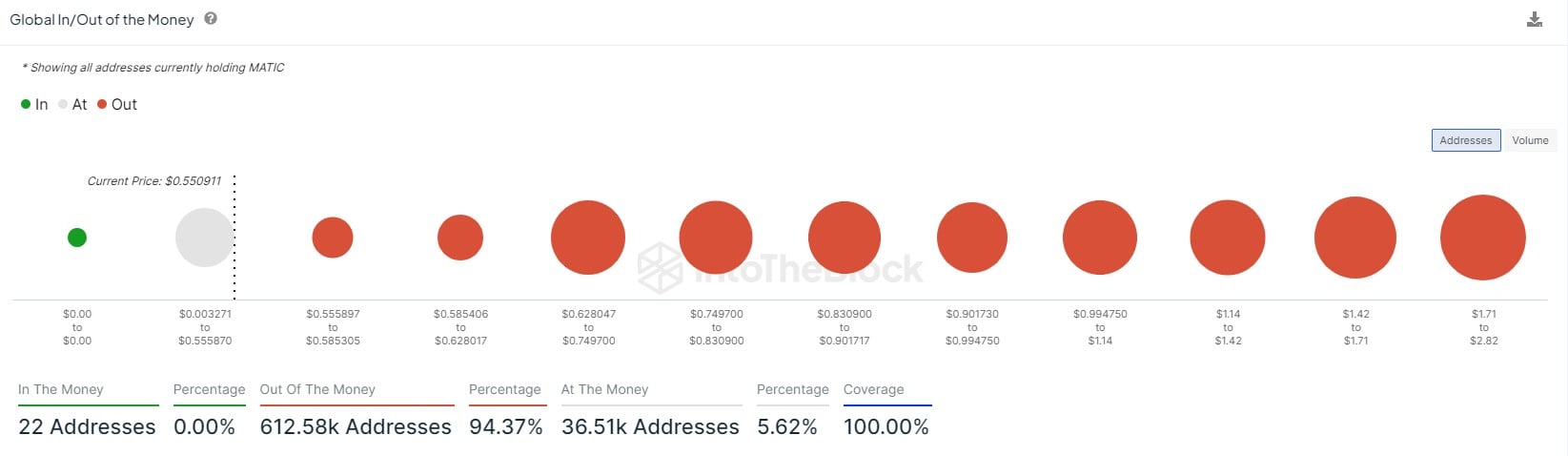

Polygon (MATIC) is displaying conflicting on-chain data trends, especially as it relates to the profitability of its addresses. According to data from crypto analytics platform IntoTheBlock (ITB), only 5.63% of Polygon addresses are either in profit or at the money or breakeven point.

Misaligned Polygon fundamentals and price trends

Polygon is a unique Ethereum-based layer-2 scaling solution. However, its uniqueness has not translated into a price surge in recent times.

The ITB data shows that no address is outright profitable on the Polygon network. The data also revealed that 3,651 are “at the money” as of press time. At the moment, a total of 612.58K addresses, or 94.37%, are “out of the money” or in losses.

This is a very concerning trend considering the widespread adoption of Polygon-focused technologies. One such, the Polygon CDK, is powering different new chains as the L2 pivots, extending its service to developers looking to build related or alternative chains.

Thus far, Polygon’s CDK is now being used by Flipkart, OKX and a host of other innovators looking to make a difference in Web3.0. Besides CDK, Polygon zkEVM is another technology that shows Polygon’s advanced capabilities.

Amid its innovations, however, MATIC remains down by up to 4.9% in 24 hours to $0.5516. Over the past month, the token has further slipped by 24.34%, accelerating the plunge in its associated ecosystem address profitability.

Common L2 trend

With most altcoins mimicking Bitcoin as it relates to key on-chain metrics, the Ethereum layer-2 ecosystem appears to have decoupled from this trend in general.

While Polygon is recording intensive address losses, Bitcoin’s address profitability is pegged at 86.81%, despite the recent sell-offs.

One consolation for Polygon is that other top L2 protocols, like Arbitrum (ARB), are also recording a similar address onslaught. Per ITB data, more than 97% of addresses are in losses, despite a large ecosystem and embrace of the product.