Bitcoin, which experienced a serious decline after its ATH of over 73 thousand dollars in March, started the new week in red.

Continuing the downward trend that started last week, BTC fell below $63,000 in the morning hours and fell to $62,170.

Analysts think that this decline was influenced by the large sales of Bitcoin miners, the German government’s transfer of a significant amount of BTC to the exchanges, and the negative sentiment in the general market.

While this sharp decline in Bitcoin was accompanied by altcoins, the largest altcoin Ethereum (ETH) fell to $ 3,350.

While ETH decreased by 3.7% in the last 24 hours, BNB, which is in the top ten outside ETH, decreased by 3.7%; Solana (SOL) 7%; XRP 3.2%; Toncoin (TON) 5%; Dogecoin (DOGE) is down 4.4% and Cardano (ADA) is down 4%.

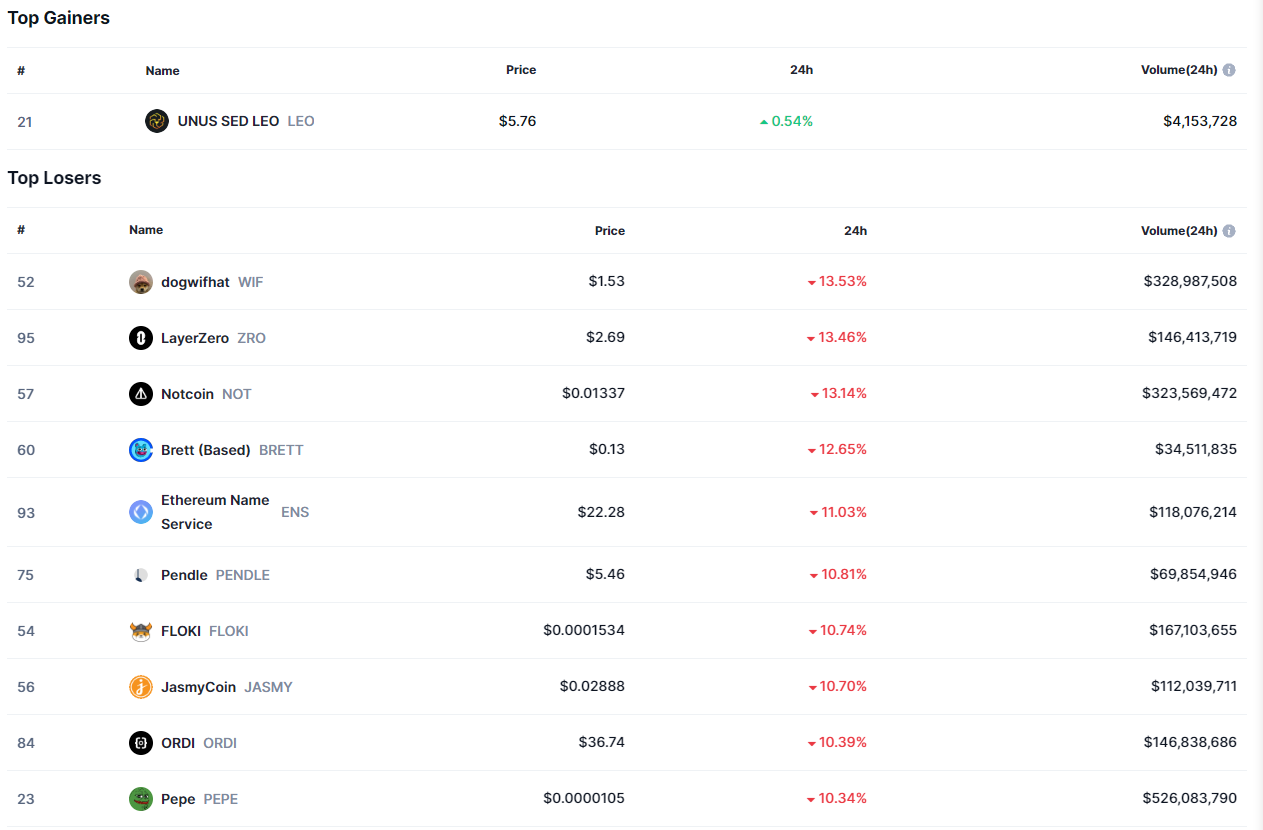

While the decline in some altcoins reached double digits, WIF was 13.5%; LayerZero (ZRO) is down 13.4% and PENDLE is down 10%.

Against this decline, only one altcoin experienced a small rise. Accordingly, LEO has increased by 0.5% in the last 24 hours.

Investors in Long Positions Left Upside Down!

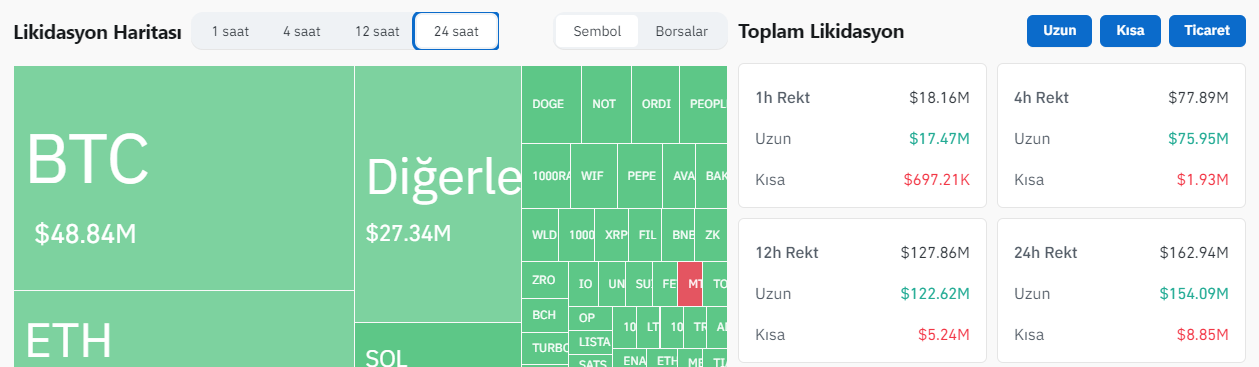

While these sharp declines were experienced in Bitcoin and altcoins, investors with long positions were also left in reverse and liquidated.

At this point, according to data from CoinGlass, $162.9 million was liquidated in crypto futures in the last 24 hours. Of this, $154 million consisted of long positions and only $8.8 million consisted of short positions.

Additionally, while 69,396 investors were liquidated in the last 24 hours, the largest liquidation took place in the XBTUSD (Bitcoin) transaction on the BitMEX exchange.

$48.8 million in Bitcoin; While $29 million was liquidated in Ethereum, BTC and ETH were followed by SOL and DOGE.

*This is not investment advice.