Over half of Japanese institutional investors plan to invest in digital assets within the next three years, according to a new survey by Nomura Holdings and its digital asset subsidiary Laser Digital.

Japanese Institutional Investors Warm to Digital Assets, Survey Finds

The study, which polled more than 500 investment managers from institutions, family offices, and public-service corporations in Japan, reveals a growing appetite for crypto assets among traditional financial players.

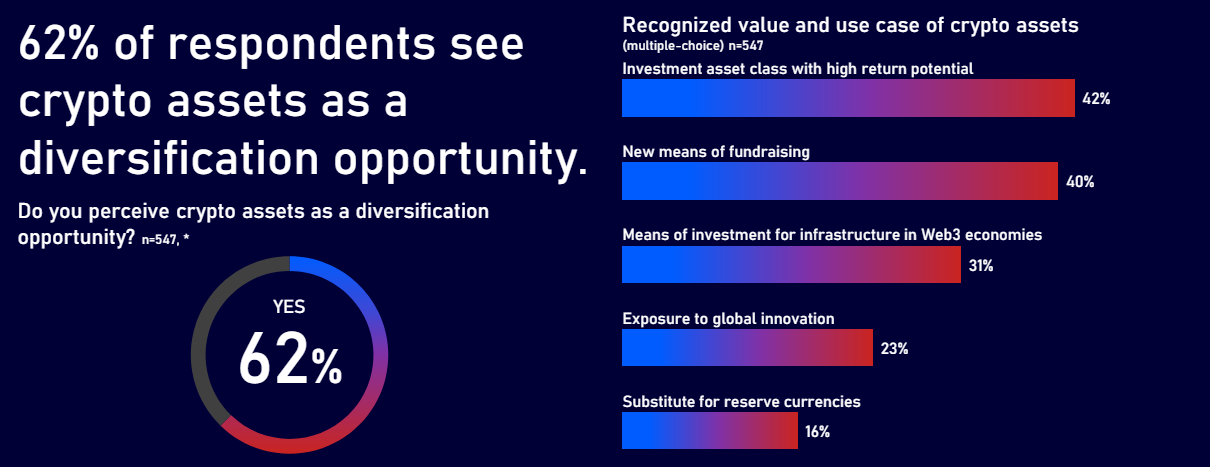

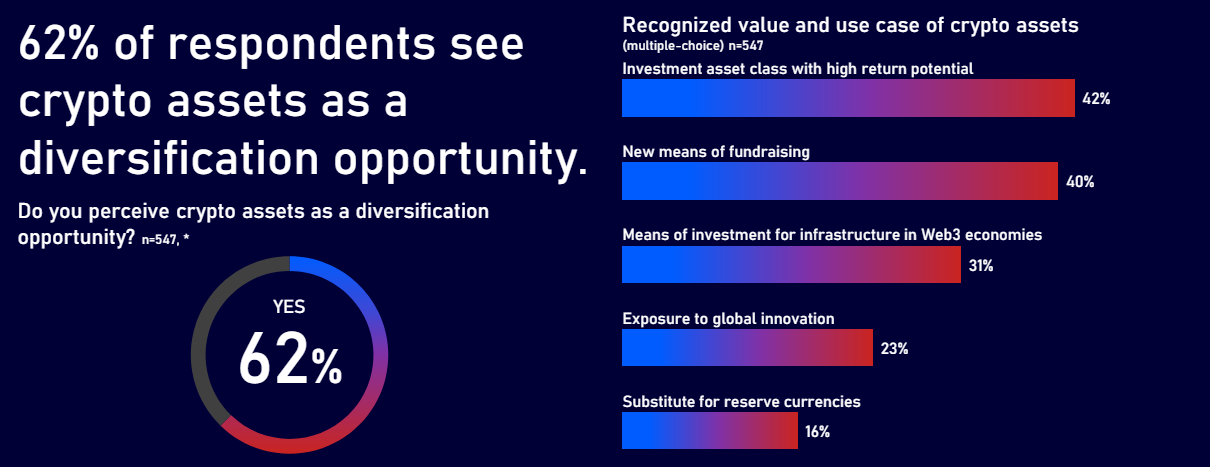

Of those surveyed, 54% indicated they intend to invest in crypto assets over the next three years. Additionally, 25% of respondents reported a “positive” impression of crypto assets, while 62% view them as a diversification opportunity.

The survey found that investors considering crypto allocations prefer a 2-5% range of assets under management. Respondents cited the development of various investment products, including ETFs, investment trusts, and staking opportunities, as key drivers for future investment.

Interestingly, about half of the respondents expressed interest in investing in Web3 projects, either directly or through venture capital funds. This interest could be bolstered by an expected revision to Japan’s Limited Partnerships Act later this year, which would add crypto assets to the list of permissible investments for limited partnerships.

Nomura and @LaserDigital_ conducted a survey of over 500 investment managers in Japan on investment trends and intentions towards digital assets, and issues when considering investing in crypto assets. Click here for the full survey results: https://t.co/bJ5iDnjWqP pic.twitter.com/5BT89QWBWw

— Nomura (@Nomura) June 24, 2024

However, the survey also identified several barriers to entry for those not currently considering crypto investments. These include concerns about counterparty risk, high volatility, and regulatory requirements.

The survey results come as Japan continues to position itself as a hub for digital asset innovation, with recent regulatory changes aimed at fostering growth in the sector while maintaining investor protections.

“As the digital asset landscape evolves, the development of a stablecoin for use in the Japanese market will be key to expanding the accessibility and adoption of digital assets in Japan and beyond,” commented Steve Ashley, the Executive Chairman at Laser Digital.

His comment, however, did not appear alongside the publication of the current survey results but rather with last month’s news that Laser Digital was among the three companies aiming to offer “stablecoin-as-a-service” in Japan.

“This project has the potential to greatly enhance digital asset accessibility and innovation in the Japanese financial landscape,” Ashley added.

A week ago, Nomura’s digital assets arm also informed that it received a Financial Services Permission (FSP) from the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Market (ADGM). The new authorization allows the company to offer broker-dealer and asset management products for traditional and virtual assets in Abu Dhabi.

Over half of Japanese institutional investors plan to invest in digital assets within the next three years, according to a new survey by Nomura Holdings and its digital asset subsidiary Laser Digital.

Japanese Institutional Investors Warm to Digital Assets, Survey Finds

The study, which polled more than 500 investment managers from institutions, family offices, and public-service corporations in Japan, reveals a growing appetite for crypto assets among traditional financial players.

Of those surveyed, 54% indicated they intend to invest in crypto assets over the next three years. Additionally, 25% of respondents reported a “positive” impression of crypto assets, while 62% view them as a diversification opportunity.

The survey found that investors considering crypto allocations prefer a 2-5% range of assets under management. Respondents cited the development of various investment products, including ETFs, investment trusts, and staking opportunities, as key drivers for future investment.

Interestingly, about half of the respondents expressed interest in investing in Web3 projects, either directly or through venture capital funds. This interest could be bolstered by an expected revision to Japan’s Limited Partnerships Act later this year, which would add crypto assets to the list of permissible investments for limited partnerships.

Nomura and @LaserDigital_ conducted a survey of over 500 investment managers in Japan on investment trends and intentions towards digital assets, and issues when considering investing in crypto assets. Click here for the full survey results: https://t.co/bJ5iDnjWqP pic.twitter.com/5BT89QWBWw

— Nomura (@Nomura) June 24, 2024

However, the survey also identified several barriers to entry for those not currently considering crypto investments. These include concerns about counterparty risk, high volatility, and regulatory requirements.

The survey results come as Japan continues to position itself as a hub for digital asset innovation, with recent regulatory changes aimed at fostering growth in the sector while maintaining investor protections.

“As the digital asset landscape evolves, the development of a stablecoin for use in the Japanese market will be key to expanding the accessibility and adoption of digital assets in Japan and beyond,” commented Steve Ashley, the Executive Chairman at Laser Digital.

His comment, however, did not appear alongside the publication of the current survey results but rather with last month’s news that Laser Digital was among the three companies aiming to offer “stablecoin-as-a-service” in Japan.

“This project has the potential to greatly enhance digital asset accessibility and innovation in the Japanese financial landscape,” Ashley added.

A week ago, Nomura’s digital assets arm also informed that it received a Financial Services Permission (FSP) from the Financial Services Regulatory Authority (FSRA) of Abu Dhabi Global Market (ADGM). The new authorization allows the company to offer broker-dealer and asset management products for traditional and virtual assets in Abu Dhabi.