Bearish forces continued to exert significant selling pressure last week, driving Bitcoin (BTC) below the critical $65,000 threshold for the first time in over a month. This downturn echoed throughout the market, resulting in prolonged losses.

Consequently, the entire market experienced substantial selloffs, leading to a $70 billion reduction in the global crypto market cap, which fell below the $2.4 trillion mark, ending the week at $2.35 trillion.

Here are our picks for top cryptocurrencies to watch this week, based on their on-chain performances and social trends:

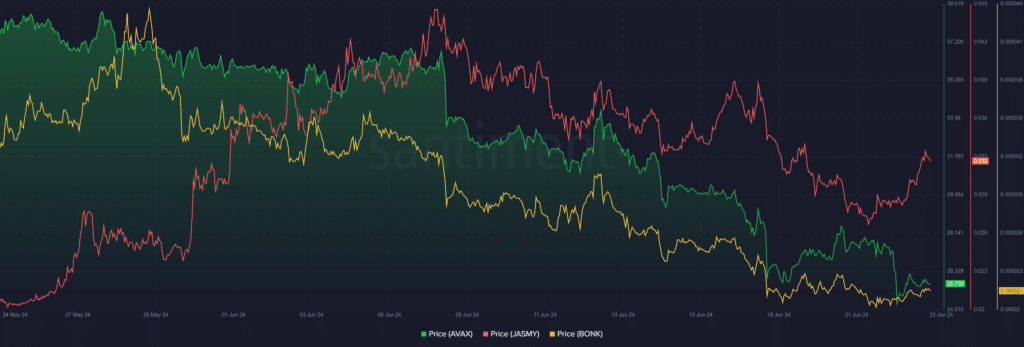

AVAX hits yearly low

Avalanche (AVAX) suffered a heavy blow, especially on June 17 and 18 when the turbulence intensified. AVAX began the week with a mild 0.23% gain, trailing Bitcoin’s meager rise that day.

However, as the Bitcoin collapse triggered a market drop, Avalanche recorded a free fall, collapsing nearly 12% within two days to trade at $26.60 for the first time since last December.

AVAX broke its record for the lowest price this year on two occasions last week. It hit a new yearly low of $24.94 on June 18, and then dropped to a lower value of $24.52 on June 22.

The asset saw a 14.66% loss last week, closing the week at $25.61. This figure marked a YTD drop of 33% for Avalanche. However, AVAX’s RSI (25.15) and CCI (-138.2) confirm that the asset is extremely oversold and may be due for a rebound.

JASMY retests lower Bollinger Band

JasmyCoin (JASMY) saw higher gains during periods of upswings. For instance, the token initially soared 12.33% on June 16, when BTC and other assets saw negligible gains.

The correction saw JASMY record four days of losses, culminating in a 25% collapse. JASMY eventually retested the lower Bollinger Band ($0.0296) on June 20, briefly dropping below it.

The asset engineered a surge to decisively push above the lower band, with an 8.52% gain on June 22. This helped JASMY reclaim some of the lost values, but it still saw a 7.46% drop last week.

Moreover, JasmyCoin continues to trade below the 20-day EMA at $0.03540 (blue line). This indicates that the asset remains in bearish territories despite the late-minute recovery.

BONK collapses

Bonk (BONK), the only meme coin on this week’s “top cryptocurrencies” list, suffered from its higher volatility. It is witnessing steeper declines than the rest of the market.

Following a 3% gain on June 16, the bears triggered a 17% crash in BONK’s price on June 17 and 18.

BONK consolidated after this sharp drop, but maintained the bearish momentum despite securing a listing on Bitstamp. It closed the week with a 15.6% drop. BONK must push above the 23.6% Fibonacci retracement ($0.00002543) and the 50-day EMA ($0.00002637) to flip its momentum to bullish.

A breach of this level could provide enough strength for the bulls to reach the $0.00002909 resistance, aligning with the 38.2% Fibonacci retracement. This would be pivotal for the journey toward the psychologically important $0.00003 territory.

Bearish forces continued to exert significant selling pressure last week, driving Bitcoin (BTC) below the critical $65,000 threshold for the first time in over a month. This downturn echoed throughout the market, resulting in prolonged losses.

Consequently, the entire market experienced substantial selloffs, leading to a $70 billion reduction in the global crypto market cap, which fell below the $2.4 trillion mark, ending the week at $2.35 trillion.

Here are our picks for top cryptocurrencies to watch this week, based on their on-chain performances and social trends:

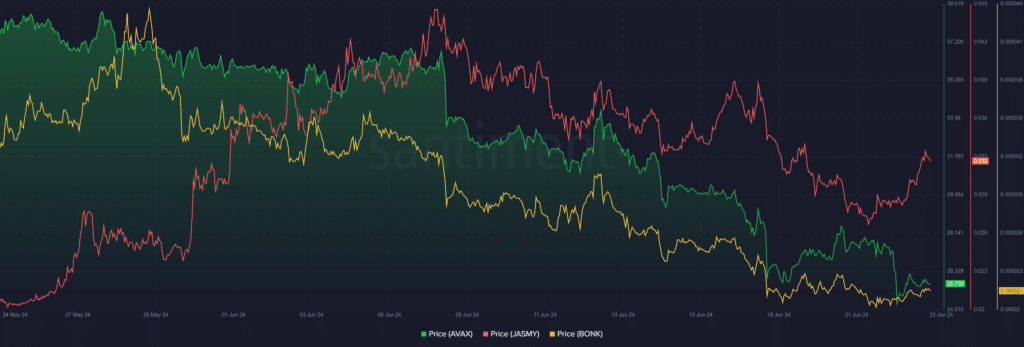

AVAX hits yearly low

Avalanche (AVAX) suffered a heavy blow, especially on June 17 and 18 when the turbulence intensified. AVAX began the week with a mild 0.23% gain, trailing Bitcoin’s meager rise that day.

However, as the Bitcoin collapse triggered a market drop, Avalanche recorded a free fall, collapsing nearly 12% within two days to trade at $26.60 for the first time since last December.

AVAX broke its record for the lowest price this year on two occasions last week. It hit a new yearly low of $24.94 on June 18, and then dropped to a lower value of $24.52 on June 22.

The asset saw a 14.66% loss last week, closing the week at $25.61. This figure marked a YTD drop of 33% for Avalanche. However, AVAX’s RSI (25.15) and CCI (-138.2) confirm that the asset is extremely oversold and may be due for a rebound.

JASMY retests lower Bollinger Band

JasmyCoin (JASMY) saw higher gains during periods of upswings. For instance, the token initially soared 12.33% on June 16, when BTC and other assets saw negligible gains.

The correction saw JASMY record four days of losses, culminating in a 25% collapse. JASMY eventually retested the lower Bollinger Band ($0.0296) on June 20, briefly dropping below it.

The asset engineered a surge to decisively push above the lower band, with an 8.52% gain on June 22. This helped JASMY reclaim some of the lost values, but it still saw a 7.46% drop last week.

Moreover, JasmyCoin continues to trade below the 20-day EMA at $0.03540 (blue line). This indicates that the asset remains in bearish territories despite the late-minute recovery.

BONK collapses

Bonk (BONK), the only meme coin on this week’s “top cryptocurrencies” list, suffered from its higher volatility. It is witnessing steeper declines than the rest of the market.

Following a 3% gain on June 16, the bears triggered a 17% crash in BONK’s price on June 17 and 18.

BONK consolidated after this sharp drop, but maintained the bearish momentum despite securing a listing on Bitstamp. It closed the week with a 15.6% drop. BONK must push above the 23.6% Fibonacci retracement ($0.00002543) and the 50-day EMA ($0.00002637) to flip its momentum to bullish.

A breach of this level could provide enough strength for the bulls to reach the $0.00002909 resistance, aligning with the 38.2% Fibonacci retracement. This would be pivotal for the journey toward the psychologically important $0.00003 territory.