Prices of AI-themed tokens, including NEAR Protocol (NEAR), are seeing notable reliefs and moving against the broader market trend. This analysis highlights the reasons for this impressive performance and what to expect of the token’s value.

It is not the first time these cryptocurrencies are charting their own path. In the past, positive developments in the Artificial intelligence industry spread to the crypto sector.

Nvidia and Panthera Offer NEAR a Way Out

As of this writing, NEAR seems to be following the playbook from previous times. On June 19, crypto hedge fund Panthera Capital announced it was raising a staggering $1 billion.

According to the firm, 15% to 20% of the fresh capital would be invested in AI-related blockchains.NEAR Protocol leverages AI and blockchain technology to scale decentralized applications.

Thus, it is no surprise that the native token of the layer-1 project reacts positively to the development.

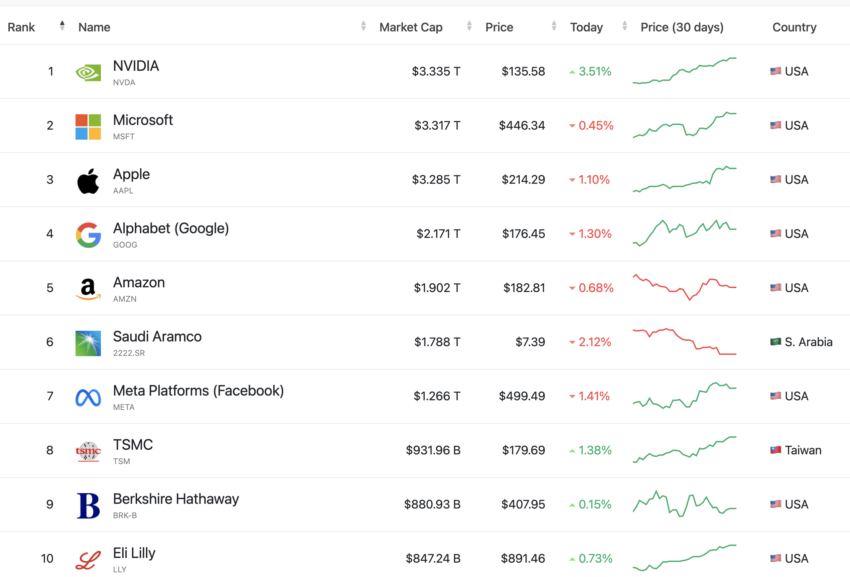

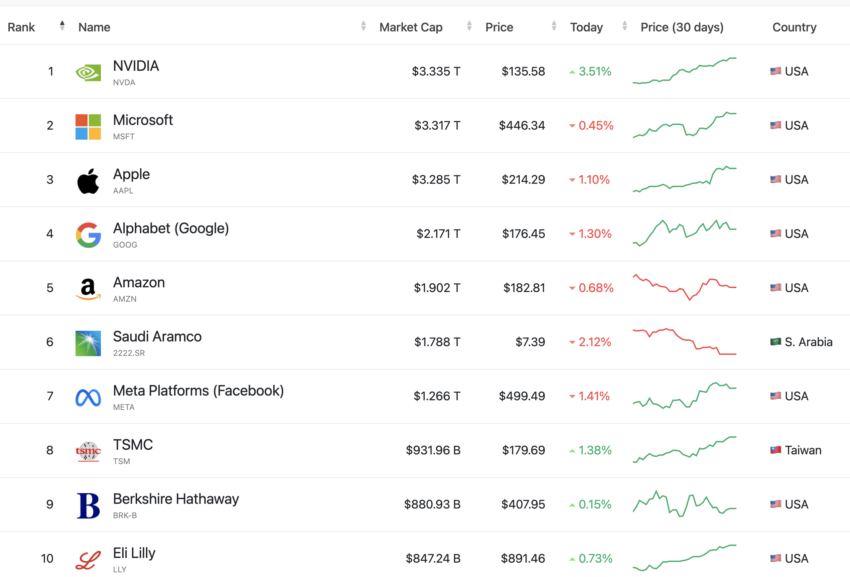

Trading at $5.40, NEAR’s price increase can also be linked to the recent Nvidia milestone. On June 18, Nvidia, the leading company in AI computing, surpassed Microsft to become the world’s most valuable company. This happened after its market capitalization reached $3.33 trillion.

Development Activity Puts a Cherry on the Cake

According to on-chain data from Santiment, development activity on the NEAR Protocol is improving. By definition, development activity provides insights into the level of work done to keep blockchain optimized at full capacity.

When the metric decreases, it means that developers are not shipping new features on the network. Therefore, the recent rise implies that public contribution to NEAR’s GitHub repositories is increasing. It is also a positive sign for the token’s price.

Read More: Top 8 NEAR Wallets in 2024

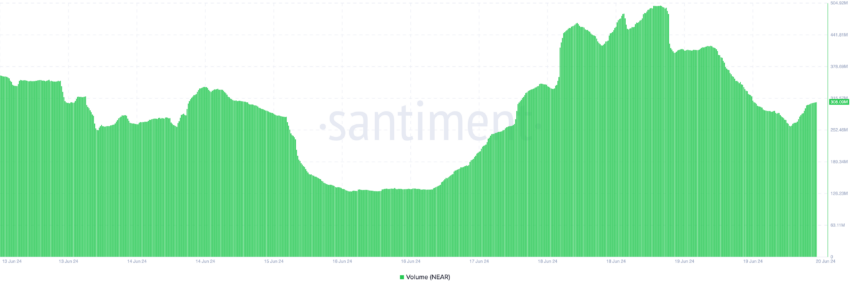

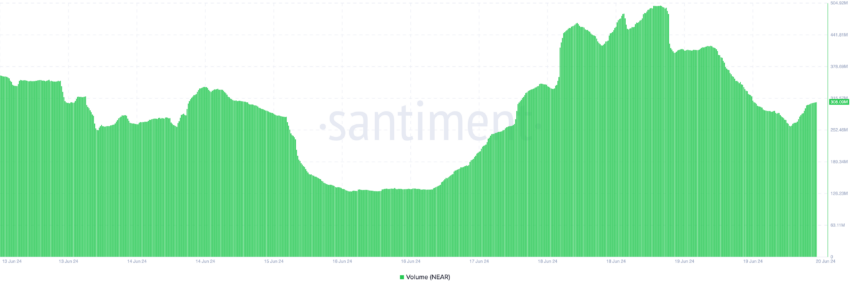

One other metric in support of the bullish prediction is NEAR’s volume. Volume measures interest in a cryptocurrency. Hence, an increase signals a rise in buying and selling, while a decrease does otherwise.

Apart from that, volume affects price. Rising volume strengthens a price trend. On the other hand, falling volume weakens the trend. As of this writing, NEAR’s volume has increased to $308.09 million.

If the volume continues to increase alongside the price, NEAR may reach $6 within a few days.

NEAR Price Prediction: Is $5.70 the Start of a Rally?

Moving on, BeInCrypto noticed a notable rise in the Money Flow Index (MFI) and On Balance Volume (OBV). MFI measures the flow of money in and out of a cryptocurrency. Further, the technical oscillator can identify overbought and oversold signals.

At press time, the indicator looks close to surpassing the 50.00 midpoint level, indicating an increase in buying pressure for the token. Specifically, the OBV measures positive and negative volume flow. Like the MFI, the indicator also indicates whether buying or selling pressure is dominant.

With the OBV increasing, NEAR’s price may continue to move upward. We analyzed the Fibonacci Retracement levels for specific targets.

The Fibonacci Retracement tool is a predictive indicator that shows a sequence of horizontal lines of potential resistance and support points. Each level is associated with a percentage; the most important ones are 23.6%, 38.2%, and 61.8%, 78.8%

Furthermore, the daily chart shows that NEAR can move to $5.70 if buying pressure increases. This is where the 61.8 Fibonacci level is positioned. In a highly bullish situation, NEAR can move to $6.15 at the 78.6% level.

Read More: What Is NEAR Protocol (NEAR)?

However, the bullish thesis will be invalidated if NEAR holders begin to take off the recent price increase. In addition, a decline in development activity may also cancel out the upswing. If this happens, NEAR’s price may fall to $5.06.

Prices of AI-themed tokens, including NEAR Protocol (NEAR), are seeing notable reliefs and moving against the broader market trend. This analysis highlights the reasons for this impressive performance and what to expect of the token’s value.

It is not the first time these cryptocurrencies are charting their own path. In the past, positive developments in the Artificial intelligence industry spread to the crypto sector.

Nvidia and Panthera Offer NEAR a Way Out

As of this writing, NEAR seems to be following the playbook from previous times. On June 19, crypto hedge fund Panthera Capital announced it was raising a staggering $1 billion.

According to the firm, 15% to 20% of the fresh capital would be invested in AI-related blockchains.NEAR Protocol leverages AI and blockchain technology to scale decentralized applications.

Thus, it is no surprise that the native token of the layer-1 project reacts positively to the development.

Trading at $5.40, NEAR’s price increase can also be linked to the recent Nvidia milestone. On June 18, Nvidia, the leading company in AI computing, surpassed Microsft to become the world’s most valuable company. This happened after its market capitalization reached $3.33 trillion.

Development Activity Puts a Cherry on the Cake

According to on-chain data from Santiment, development activity on the NEAR Protocol is improving. By definition, development activity provides insights into the level of work done to keep blockchain optimized at full capacity.

When the metric decreases, it means that developers are not shipping new features on the network. Therefore, the recent rise implies that public contribution to NEAR’s GitHub repositories is increasing. It is also a positive sign for the token’s price.

Read More: Top 8 NEAR Wallets in 2024

One other metric in support of the bullish prediction is NEAR’s volume. Volume measures interest in a cryptocurrency. Hence, an increase signals a rise in buying and selling, while a decrease does otherwise.

Apart from that, volume affects price. Rising volume strengthens a price trend. On the other hand, falling volume weakens the trend. As of this writing, NEAR’s volume has increased to $308.09 million.

If the volume continues to increase alongside the price, NEAR may reach $6 within a few days.

NEAR Price Prediction: Is $5.70 the Start of a Rally?

Moving on, BeInCrypto noticed a notable rise in the Money Flow Index (MFI) and On Balance Volume (OBV). MFI measures the flow of money in and out of a cryptocurrency. Further, the technical oscillator can identify overbought and oversold signals.

At press time, the indicator looks close to surpassing the 50.00 midpoint level, indicating an increase in buying pressure for the token. Specifically, the OBV measures positive and negative volume flow. Like the MFI, the indicator also indicates whether buying or selling pressure is dominant.

With the OBV increasing, NEAR’s price may continue to move upward. We analyzed the Fibonacci Retracement levels for specific targets.

The Fibonacci Retracement tool is a predictive indicator that shows a sequence of horizontal lines of potential resistance and support points. Each level is associated with a percentage; the most important ones are 23.6%, 38.2%, and 61.8%, 78.8%

Furthermore, the daily chart shows that NEAR can move to $5.70 if buying pressure increases. This is where the 61.8 Fibonacci level is positioned. In a highly bullish situation, NEAR can move to $6.15 at the 78.6% level.

Read More: What Is NEAR Protocol (NEAR)?

However, the bullish thesis will be invalidated if NEAR holders begin to take off the recent price increase. In addition, a decline in development activity may also cancel out the upswing. If this happens, NEAR’s price may fall to $5.06.