- Ethereum ETF issuers are expected to file updated S-1s before weekend following Bitwise filings.

- SEC didn’t explicitly declare ETH a commodity despite closing Ethereum 2.0 investigation.

- Ethereum’s increased implied volatility may be misleading as institutions may employ similar cash-and-carry arbitrage strategy when spot ETH ETFs launch.

Ethereum’s (ETH) price increased over 4% in the past 24 hours after the Securities & Exchange Commission (SEC) dropped its Ethereum 2.0 investigations amid expectations of spot ETH ETFs. However, the recent excitement surrounding ETH ETFs may not lead to the expected price increase.

Daily digest market movers: Bitwise files updated ETH ETF S-1, SEC drops Ethereum 2.0 investigation

Bitwise filed an updated S-1 draft for its spot ETH ETF with the SEC after the agency commented on issuers’ initial S-1 filings last week. The filing disclosed that asset manager Pantera Capital will purchase $100 million of the ETF shares when it launches.

Also read: Global Ethereum ETFs experience surge in net inflows as Hashdex files for combined spot ETH and Bitcoin ETF

Bloomberg analyst Eric Balchunas had earlier shifted his over/under date prediction for when ETH ETFs will launch to July 2 after saying he heard that the SEC’s first round of comments on the S-1s were “light” and “nothing major.” He also mentioned that the agency expects issuers to return these drafts before the end of the week with a decent chance of working to declare them effective next week.

Meanwhile, Ethereum infrastructure provider Consensys announced that the SEC’s enforcement division is closing its investigation into Ethereum 2.0, meaning that the agency “will not bring charges alleging that sales of ETH are securities transactions.”

Consensys disclosed that the decision comes after it sent a letter to the SEC on June 7 asking whether the approval of spot ETH ETFs on May 23 indicates the agency would end its Ethereum 2.0 investigation.

Read more: Ethereum survives SEC scrutiny: Enforcement division closes investigation into Ether, Consensys says

However, the SEC’s letter to Consensys didn’t confirm whether it was concluding that ETH is a commodity. SEC Chair Gary Gensler also failed to give a direct answer when questioned if ETH is a commodity in a Senate hearing last week.

Fortune earlier reported that the SEC began investigating the Ethereum Foundation and several Ethereum-related firms based on ETH’s potential security status.

ETH technical analysis: Could Ethereum’s price fail to rise following ETF launch?

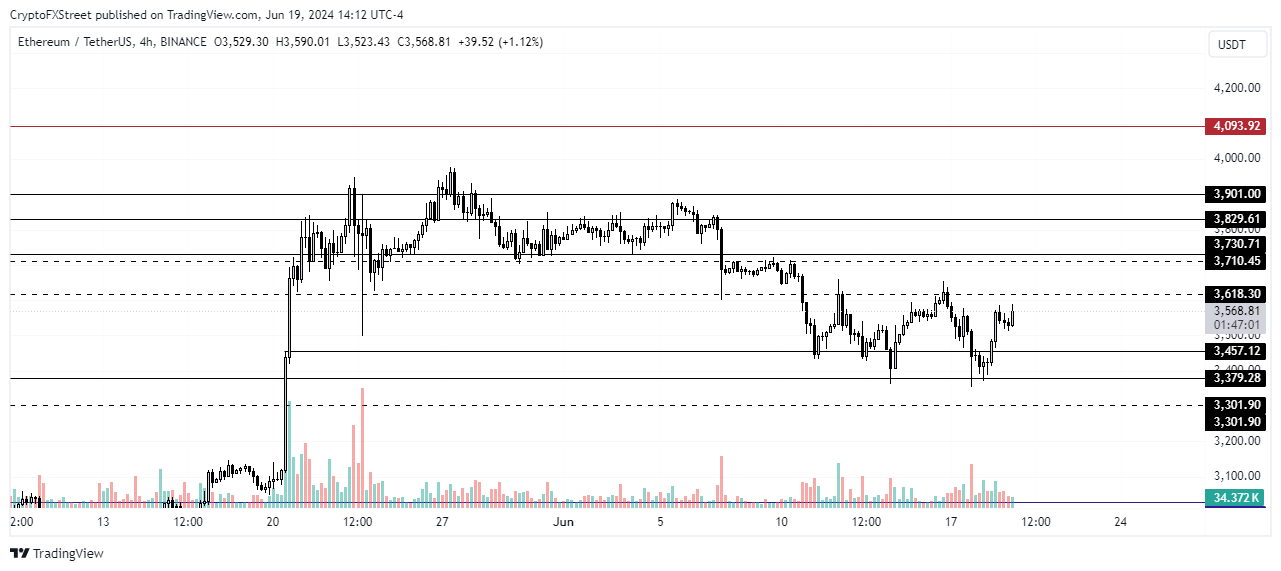

Ethereum is trading around $3,557, up more than 4% in the past 24 hours. Total ETH liquidations in the past 24 hours are at $34.37 million with $22.34 million in short liquidations exceeding those of longs.

ETH implied volatility (IV) rose to 65% in the front end after its price rebounded following the latest developments discussed above, according to QCP Capital analysts. Implied volatility measures how much the market expects the future price of an asset or options contract to change over a certain period.

“Despite uncertainty surrounding the reception of ETH ETFs, capturing 10-20% of BTC ETF flows will propel them above $4,000, nearing its peak of $4,800,” noted the analysts.

Also read: Ethereum resumes downtrend as Canada sees another staked ETH ETF launch

However, Amberdata’s director of derivatives, Greg Magadini, believes the current excitement surrounding spot ETH ETFs and its expected impact on the price of ETH may be unfounded.

“I continue to remain skeptical that this relative volatility premium remains persistent. A lot of cold water was splashed on the BTC ETF inflows narrative, given the speculation that funds are merely trading the BTC basis as opposed to taking outright ETF exposure,” wrote Magadini.

The statement follows a stalemate in Bitcoin’s price despite record ETF inflows after reports that hedge funds are employing a cash-and-carry arbitrage strategy on the top digital asset. Typically, hedge funds gain spot exposure to Bitcoin through spot BTC ETFs and then short its equivalent futures contract, profiting from its higher futures premium and funding rate fees.

Magadini expects institutions to employ a similar strategy with ETH ETFs when they go live, potentially triggering a sideways price movement for the number one altcoin.

He also pointed to the Chicago Mercantile Exchange’s (CME) Ethereum open interest (OI) compared to Bitcoin.

“The true resolution to this question [about persistent of [E]ther vol premium] comes when we see the actual ETF inflows and volume. If this looks anything like the CME OI between BTC futures and ETH futures, I think ETH still doesn’t have the mainstream enthusiasm that BTC has seen,” noted Magadini.

ETH/USDT 4-hour chart

As of the time of writing, Ethereum CME OI is at $1.32 billion, while Bitcoin’s figure is $10.14 billion.

A breakout above the $3,900 resistance could see ETH beat this cycle’s current high of $4,000 and rally to a new all-time high above the $4,878 price level. However, a breach below the $3,300 support may send ETH crashing to lows around the $2,852 level.