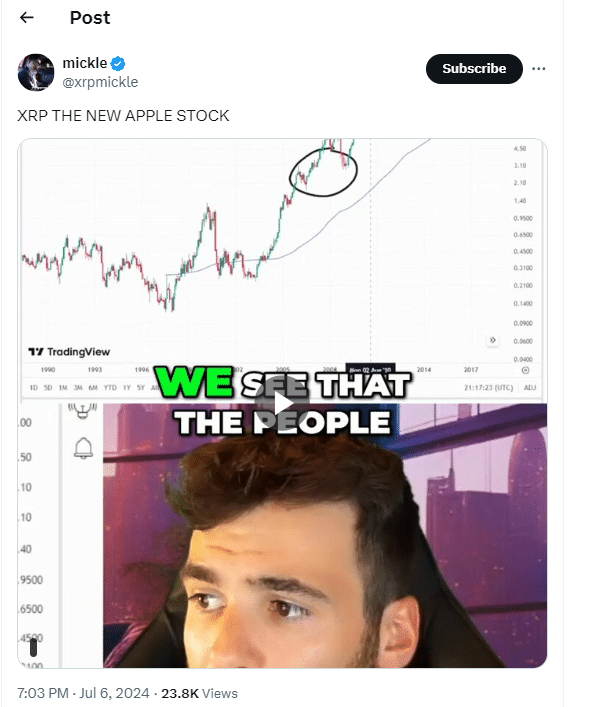

Mickle, a widely followed U.S.-based wealth advisor, has boldly asserted that XRP could be seen as the new Apple stock (AAPL).

He shared this audacious view in a recent post on X, drawing attention to AAPL’s historical trajectory. Notably, Apple stock has been bullish in recent weeks, opposing the bearish volatility in the crypto scene. Specifically, AAPL has risen by 4.9% in the last five days and 15.83% in one month.

In contrast, Bitcoin has crashed by 12% in the past week, cumulatively shredding 20% of its value in the last 30 days. A similar double-digit percentage price crash is observable for XRP and Ethereum.

Apple Stockholders in Massive Profit

In his commentary, Mickle emphasized that investors who simply held onto AAPL without overcomplicating their strategy have seen returns as high as 8,000% to date, and the stock continues to rise. He noted that holding AAPL was as straightforward as recognizing Apple’s potential with the iPhone, anticipating its dominance in the mobile industry, and monitoring its ongoing success.

Reviewing Apple’s historical chart, Mickle pointed out that the stock has generally trended upward, with few alarming moments. Despite Bitcoin’s higher volatility, he argued that BTC shows a similar long-term upward trajectory.

According to TradingView data, AAPL’s five-year trajectory shows a profit of 345%, comparable to Bitcoin’s 350% over the same period. However, AAPL’s all-time ROI is 176,250%, which pales compared to the 529,630% ROI realized by BTC holders.

How XRP May Be Seen as New Apple Stock

Mickle’s argument that XRP is the new Apple stock is based on the idea that investors can similarly hold XRP and expect significant gains without overcomplicating their strategy. This is by recognizing XRP’s substantial utility in the global payment market, worth trillions of dollars, and anticipating that as XRP adoption grows, so will its value.

Notably, TradingView data shows XRP has only increased by 8.45% over five years, far below the returns for AAPL holders. It is important to note that Apple has been in the market for over four decades, while XRP is only 11 years old.

Industry pundits such as Panos Mekras, co-founder of Anodos Finance, have boldly asserted that investing in XRP has more upside potential than Apple, Amazon, and Netflix stocks.

Similarly, renowned crypto analyst EGRAG recently argued that trading XRP at its current low value might be comparable to those who sold off Apple, Google, Amazon, and Tesla stocks in their early stages.

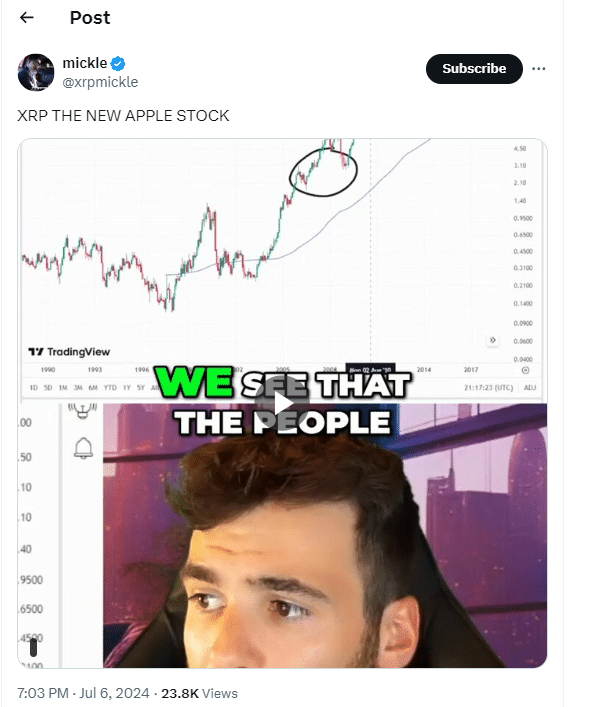

Mickle, a widely followed U.S.-based wealth advisor, has boldly asserted that XRP could be seen as the new Apple stock (AAPL).

He shared this audacious view in a recent post on X, drawing attention to AAPL’s historical trajectory. Notably, Apple stock has been bullish in recent weeks, opposing the bearish volatility in the crypto scene. Specifically, AAPL has risen by 4.9% in the last five days and 15.83% in one month.

In contrast, Bitcoin has crashed by 12% in the past week, cumulatively shredding 20% of its value in the last 30 days. A similar double-digit percentage price crash is observable for XRP and Ethereum.

Apple Stockholders in Massive Profit

In his commentary, Mickle emphasized that investors who simply held onto AAPL without overcomplicating their strategy have seen returns as high as 8,000% to date, and the stock continues to rise. He noted that holding AAPL was as straightforward as recognizing Apple’s potential with the iPhone, anticipating its dominance in the mobile industry, and monitoring its ongoing success.

Reviewing Apple’s historical chart, Mickle pointed out that the stock has generally trended upward, with few alarming moments. Despite Bitcoin’s higher volatility, he argued that BTC shows a similar long-term upward trajectory.

According to TradingView data, AAPL’s five-year trajectory shows a profit of 345%, comparable to Bitcoin’s 350% over the same period. However, AAPL’s all-time ROI is 176,250%, which pales compared to the 529,630% ROI realized by BTC holders.

How XRP May Be Seen as New Apple Stock

Mickle’s argument that XRP is the new Apple stock is based on the idea that investors can similarly hold XRP and expect significant gains without overcomplicating their strategy. This is by recognizing XRP’s substantial utility in the global payment market, worth trillions of dollars, and anticipating that as XRP adoption grows, so will its value.

Notably, TradingView data shows XRP has only increased by 8.45% over five years, far below the returns for AAPL holders. It is important to note that Apple has been in the market for over four decades, while XRP is only 11 years old.

Industry pundits such as Panos Mekras, co-founder of Anodos Finance, have boldly asserted that investing in XRP has more upside potential than Apple, Amazon, and Netflix stocks.

Similarly, renowned crypto analyst EGRAG recently argued that trading XRP at its current low value might be comparable to those who sold off Apple, Google, Amazon, and Tesla stocks in their early stages.