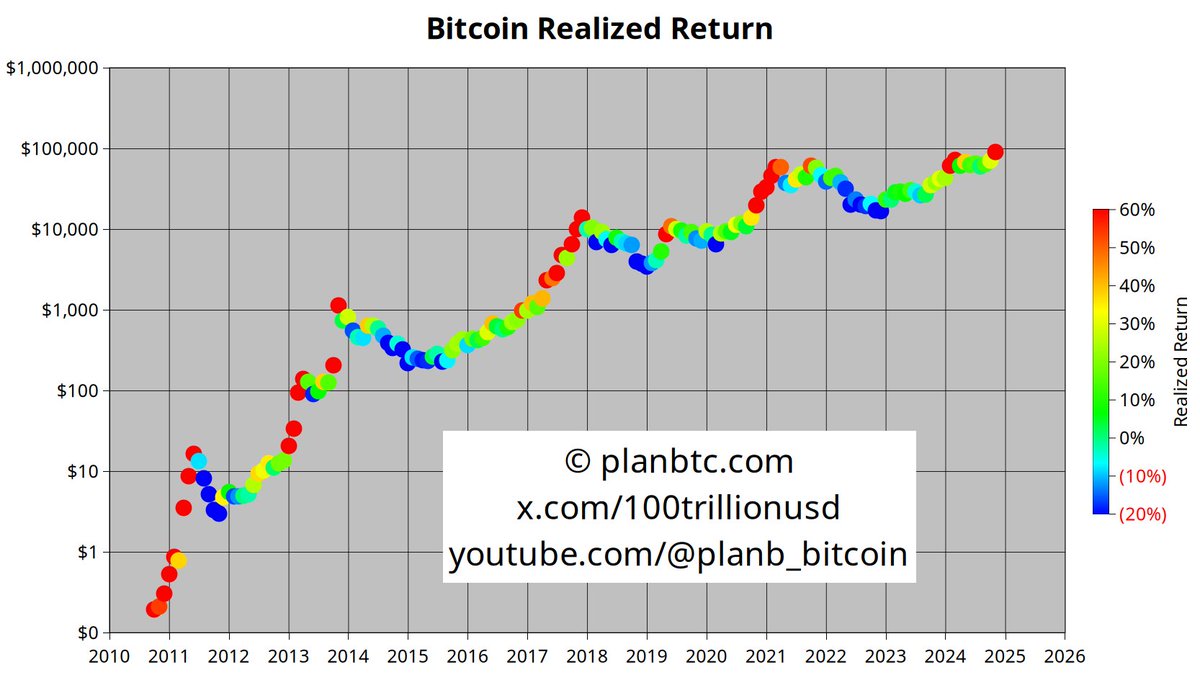

The popular crypto analyst PlanB believes Bitcoin (BTC) may not see a market correction until after breaking into the six-figure range due to one key metric.

The pseudonymous trader tells his 2 million followers on the social media platform X that Bitcoin holders appear to be selling ahead of a possible $100,000 price target.

According to the analyst, the Bitcoin profit-taking may actually mean a significant dip at the six-figure target will not occur.

“Who sells Bitcoin now? Easy: sellers are profit-takers. On average November sellers sold at more than 60% profit (red) with a cost price of $55,000. I guess people expect a dip at $100,000 and are front-running that expected $100,000 dip. This might mean there won’t be a $ 100,000 dip!”

The realized return is a metric that indicates the total profit or loss of a Bitcoin investment based on the price at which the coins were last moved.

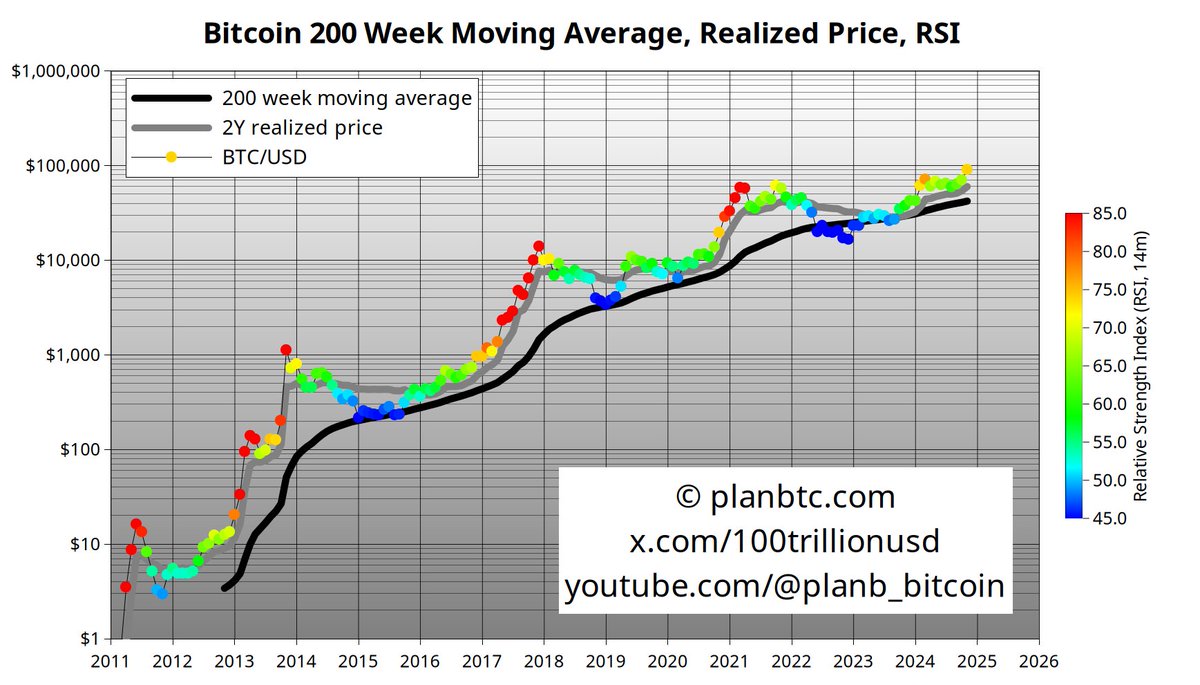

Next up, the analyst says that Bitcoin’s relative strength index (RSI) – a momentum oscillator used to analyze whether an asset is overbought or oversold – has yet to peak based on prior bull market cycles, suggesting the uptrend will continue.

He also shares a chart of the realized price metric, which records the value of all coins in a current time frame at the price they were last transacted on-chain, divided by the number of BTC in circulation. The chart suggests that Bitcoin is holding as support for the two-year realized price level, which the flagship digital asset has held in previous bull market cycles.

“Color in this chart is RSI. RSI is 74 now (yellow/orange). Imagine what RSI 80+ (red) will be like! Two-year realized price (gray line) is increasing sharply, just like at the start of 2013, 2017, 2020/21 bull markets. Two-year realized price is $60,000 now. In bull markets, Bitcoin never dips below two-year realized price.”

Bitcoin is trading for $94,290 at time of writing, about 6% below the $100,000 level.

Generated Image: Midjourney

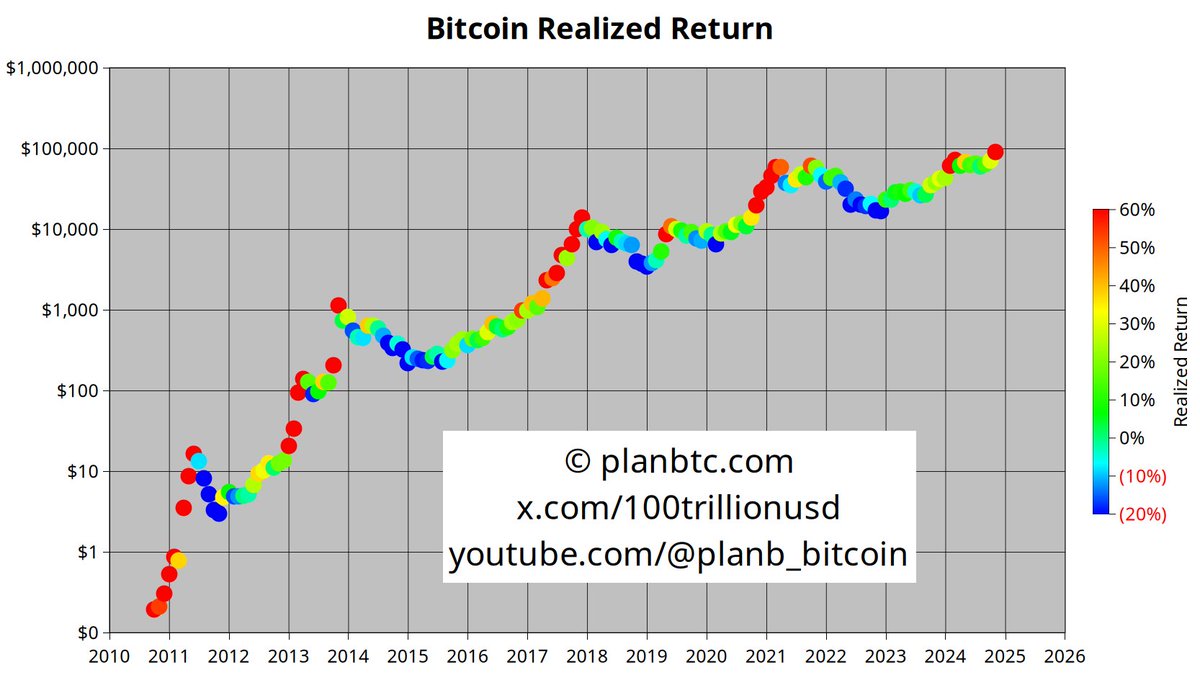

The popular crypto analyst PlanB believes Bitcoin (BTC) may not see a market correction until after breaking into the six-figure range due to one key metric.

The pseudonymous trader tells his 2 million followers on the social media platform X that Bitcoin holders appear to be selling ahead of a possible $100,000 price target.

According to the analyst, the Bitcoin profit-taking may actually mean a significant dip at the six-figure target will not occur.

“Who sells Bitcoin now? Easy: sellers are profit-takers. On average November sellers sold at more than 60% profit (red) with a cost price of $55,000. I guess people expect a dip at $100,000 and are front-running that expected $100,000 dip. This might mean there won’t be a $ 100,000 dip!”

The realized return is a metric that indicates the total profit or loss of a Bitcoin investment based on the price at which the coins were last moved.

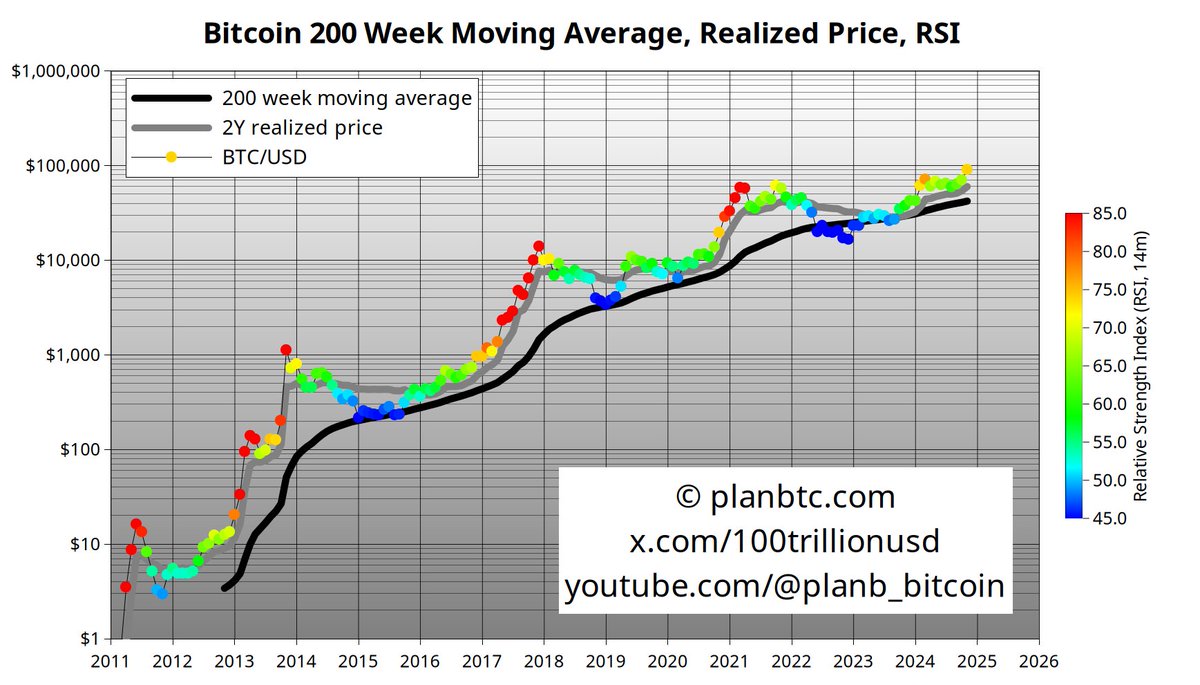

Next up, the analyst says that Bitcoin’s relative strength index (RSI) – a momentum oscillator used to analyze whether an asset is overbought or oversold – has yet to peak based on prior bull market cycles, suggesting the uptrend will continue.

He also shares a chart of the realized price metric, which records the value of all coins in a current time frame at the price they were last transacted on-chain, divided by the number of BTC in circulation. The chart suggests that Bitcoin is holding as support for the two-year realized price level, which the flagship digital asset has held in previous bull market cycles.

“Color in this chart is RSI. RSI is 74 now (yellow/orange). Imagine what RSI 80+ (red) will be like! Two-year realized price (gray line) is increasing sharply, just like at the start of 2013, 2017, 2020/21 bull markets. Two-year realized price is $60,000 now. In bull markets, Bitcoin never dips below two-year realized price.”

Bitcoin is trading for $94,290 at time of writing, about 6% below the $100,000 level.

Generated Image: Midjourney