Ethereum price witnesses a 24-hour drop of up to 5.78%, as its Relative Strength Index (RSI) hits lowest level since August 2023, suggesting oversold conditions.

Market veteran Michael van de Poppe, disclosed this in a recent report. This sharp decline indicates significant bearish momentum, suggesting Ethereum might be oversold. Furthermore, altcoins have reached their lowest RSI levels, either historically or for this cycle, indicating a widespread market capitulation.

#Ethereum reaches the lowest RSI (Daily) since the collapse in August ’23.#Altcoins have reached their lowest RSI (Daily) ever or of this cycle.

Clear capitulation. pic.twitter.com/9eehaITkQI

— Michaël van de Poppe (@CryptoMichNL) July 5, 2024

Potential Downward Targets for Ethereum Price

Ethereum price currently hovers around $2,956, marking a 5.78% decline over the past 24 hours. Key resistance is identified between $3,800 and $4,200, where Ethereum struggled to break through, leading to its recent decline. The price now faces crucial support at $2,480. A breach below this level could trigger further declines towards $2,145.

Despite the decline, trading volume remains stable, indicating the absence of panic selling. This stability suggests that while the market sentiment is bearish, a potential rebound or consolidation phase could be on the horizon.

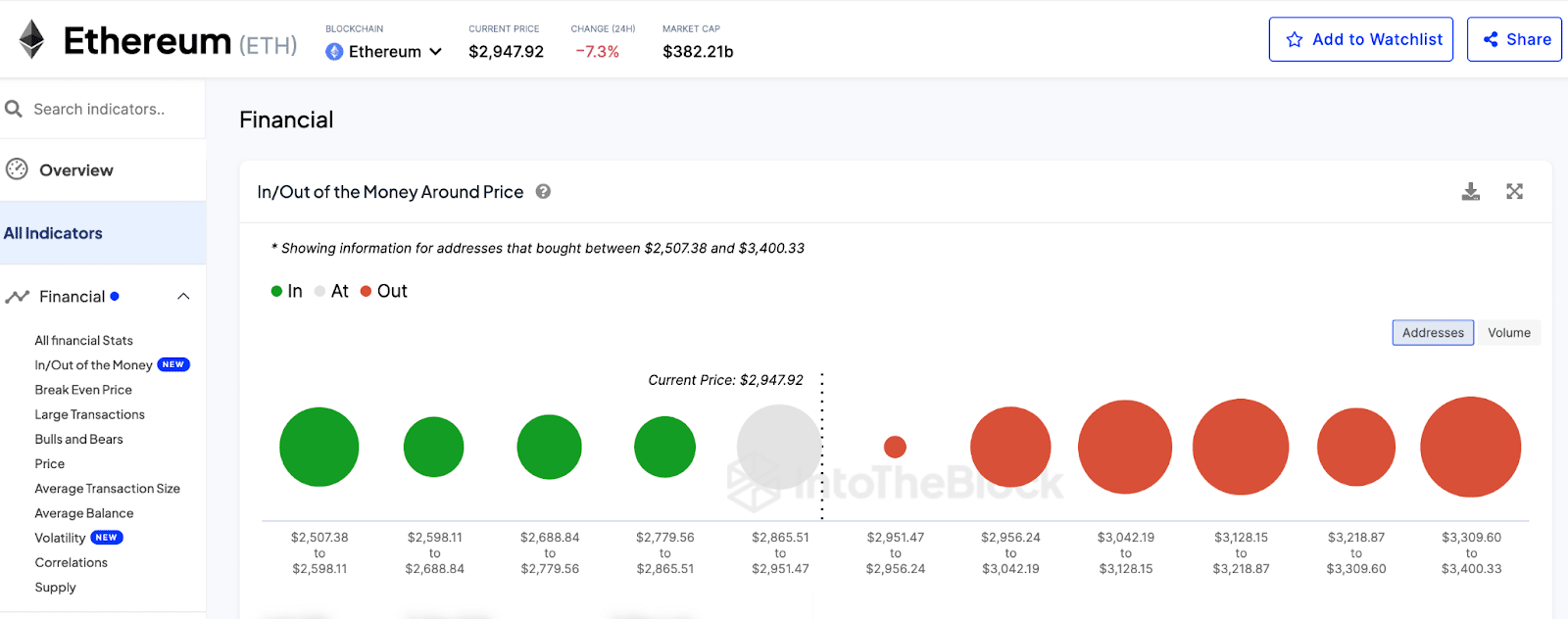

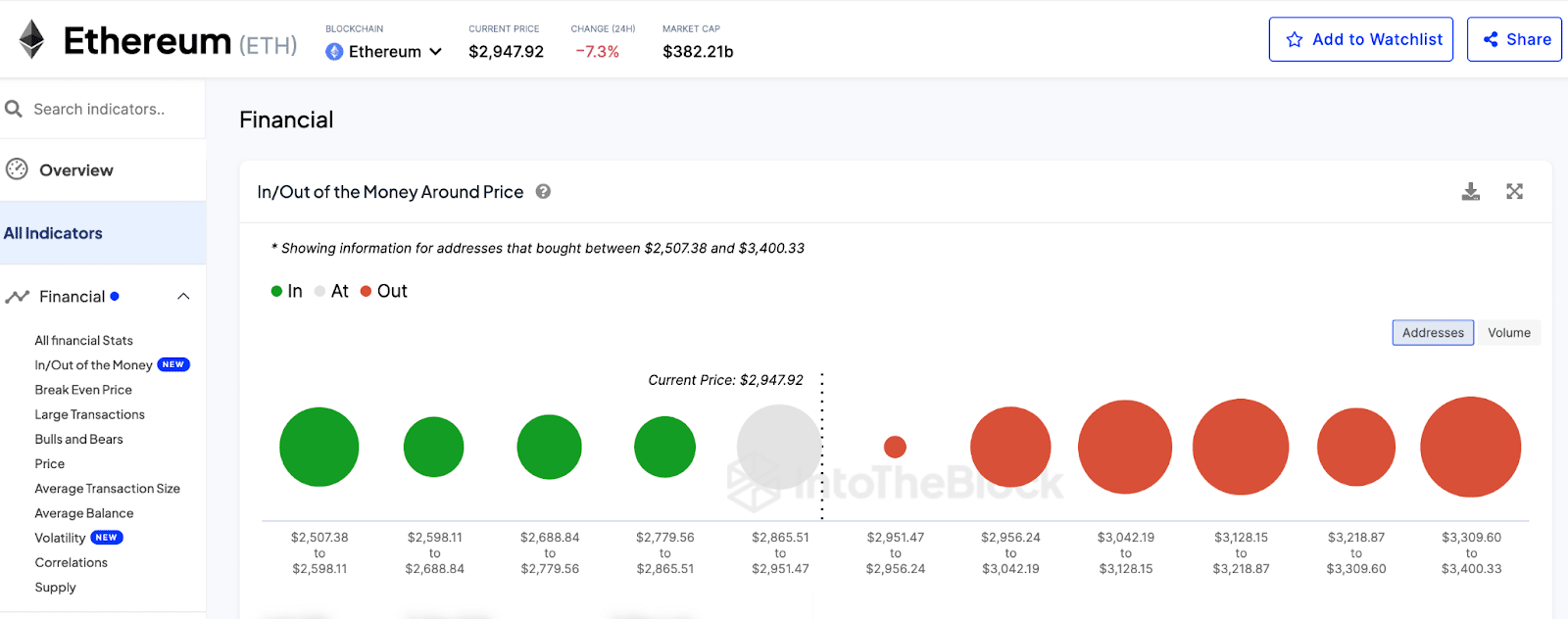

Price Impact on Holder Profitability

Analyzing Ethereum addresses, varying positions are seen based on the current price of $2,956. Notably, a significant number of addresses are “Out of the Money,” having purchased ETH at prices ranging from $2,951.47 to $3,400.33, thus currently incurring losses.

Market Sentiment and Investment Flows

Meanwhile, a previous report from CoinShares highlighted continued outflow from crypto investment products, totaling $30 million over the past three weeks, according to The Crypto Basic.

Ethereum alone saw an outflow of $61 million. Despite this, Bitcoin-related exchange-traded products (ETPs) experienced an inflow of $10 million, bringing the total assets across all Bitcoin ETPs to $67.57 billion.

Interestingly, other digital assets also saw positive net inflows. Multi-asset ETPs attracted $18 million, while Solana, Litecoin, Chainlink, and XRP recorded inflows of $1.6 million, $1.4 million, $600,000, and $300,000 respectively. Ethereum’s unique outflow data suggests increased bearish sentiments surrounding the asset.

Ethereum price witnesses a 24-hour drop of up to 5.78%, as its Relative Strength Index (RSI) hits lowest level since August 2023, suggesting oversold conditions.

Market veteran Michael van de Poppe, disclosed this in a recent report. This sharp decline indicates significant bearish momentum, suggesting Ethereum might be oversold. Furthermore, altcoins have reached their lowest RSI levels, either historically or for this cycle, indicating a widespread market capitulation.

#Ethereum reaches the lowest RSI (Daily) since the collapse in August ’23.#Altcoins have reached their lowest RSI (Daily) ever or of this cycle.

Clear capitulation. pic.twitter.com/9eehaITkQI

— Michaël van de Poppe (@CryptoMichNL) July 5, 2024

Potential Downward Targets for Ethereum Price

Ethereum price currently hovers around $2,956, marking a 5.78% decline over the past 24 hours. Key resistance is identified between $3,800 and $4,200, where Ethereum struggled to break through, leading to its recent decline. The price now faces crucial support at $2,480. A breach below this level could trigger further declines towards $2,145.

Despite the decline, trading volume remains stable, indicating the absence of panic selling. This stability suggests that while the market sentiment is bearish, a potential rebound or consolidation phase could be on the horizon.

Price Impact on Holder Profitability

Analyzing Ethereum addresses, varying positions are seen based on the current price of $2,956. Notably, a significant number of addresses are “Out of the Money,” having purchased ETH at prices ranging from $2,951.47 to $3,400.33, thus currently incurring losses.

Market Sentiment and Investment Flows

Meanwhile, a previous report from CoinShares highlighted continued outflow from crypto investment products, totaling $30 million over the past three weeks, according to The Crypto Basic.

Ethereum alone saw an outflow of $61 million. Despite this, Bitcoin-related exchange-traded products (ETPs) experienced an inflow of $10 million, bringing the total assets across all Bitcoin ETPs to $67.57 billion.

Interestingly, other digital assets also saw positive net inflows. Multi-asset ETPs attracted $18 million, while Solana, Litecoin, Chainlink, and XRP recorded inflows of $1.6 million, $1.4 million, $600,000, and $300,000 respectively. Ethereum’s unique outflow data suggests increased bearish sentiments surrounding the asset.