Most holders of the popular meme coin Floki (FLOKI) currently have significant unrealized gains.

However, the steady decline in the token’s price has led them to adopt a bearish outlook and position themselves against any potential price rally.

Floki Prints Gains, But Holders Remain Cautious

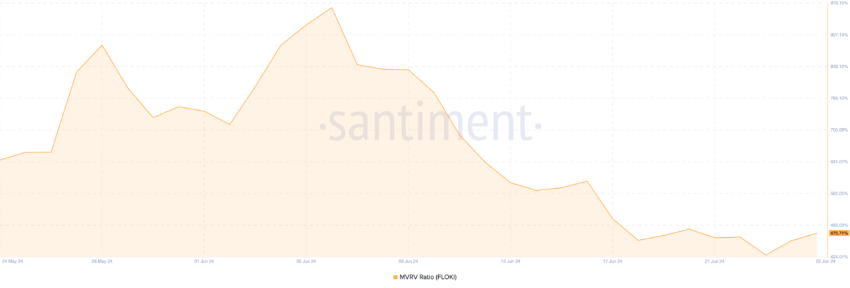

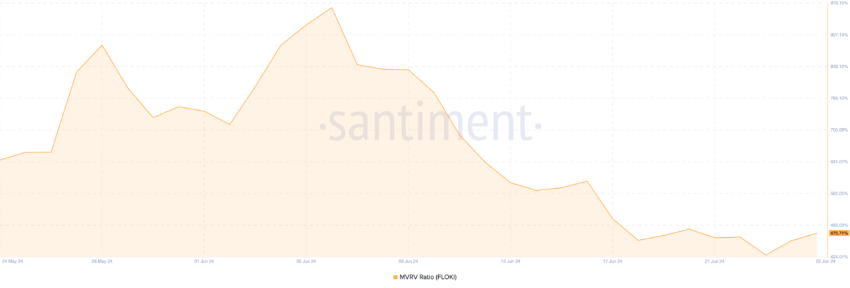

An assessment of FLoki’s Market Value to Realized Value (MVRV) ratio shows that many of its investors currently hold their tokens at a profit.

An asset’s MVRV ratio tracks the ratio between its current market price and the average price at which each coin or token was acquired.

When the metric’s value is above one and positive, the asset is said to be overvalued. This means that the asset’s current market value is significantly higher than the price at which most investors acquire their holdings. This suggests that selling at that moment would result in profits.

Conversely, a negative MVRV ratio means that the asset is undervalued. This means that its current market value is lower than the average purchase price of all of its tokens in circulation. If traders sell, they would record a profit.

As of this writing, FLOKI’s MVRV ratio is 475.71%. At this value, the meme coin holders currently hold positions worth four times their initial investment.

Read More: What Are Meme Coins?

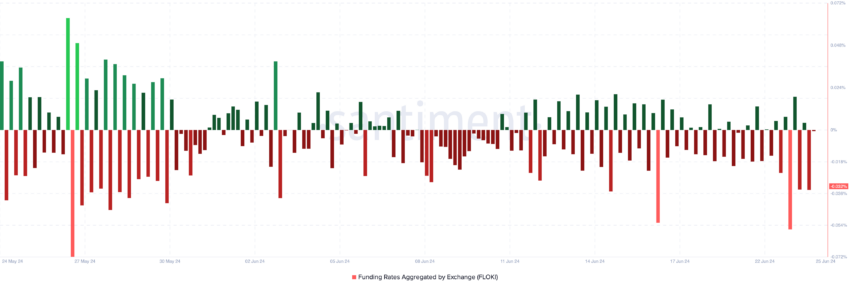

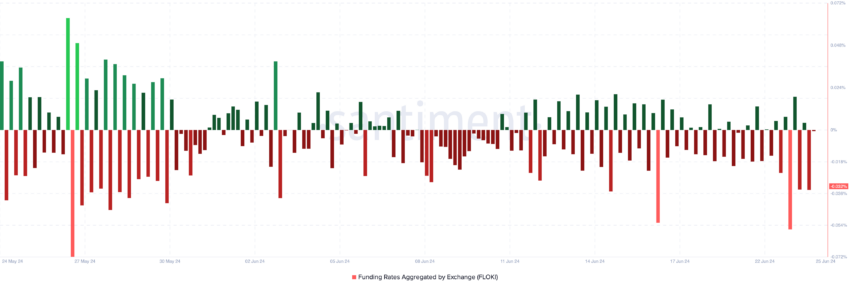

With such high profits available, there is a potential for increased selling pressure from investors looking to lock in their gains. This has caused FLOKI’s derivatives traders to demand more short positions in the past few days.

As of this writing, the meme coin’s aggregated funding rate across cryptocurrency exchanges is -0.03%.

Funding rates ensure the contract price stays close to the spot price in perpetual futures contracts. When it is negative like this, more traders are holding short positions.

Accordingly, it suggests that there are more traders who expect the asset’s price to fall than there are those who buy it in anticipation of selling at a higher price.

FLOKI Price Prediction: The Meme Coin Risks Falling by 13%

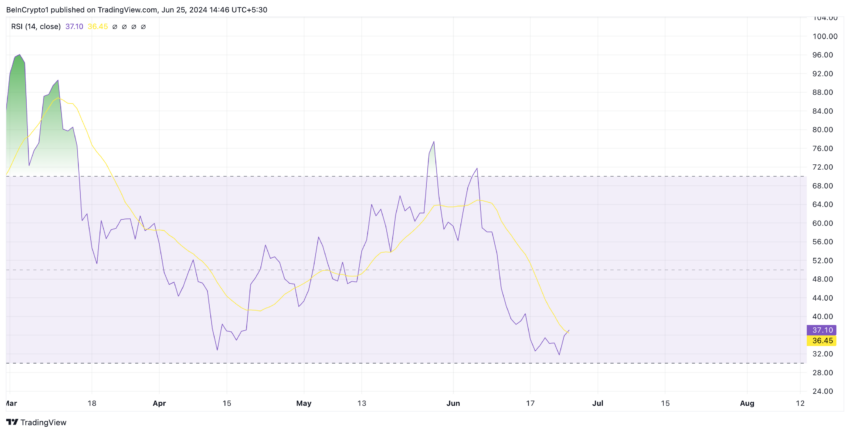

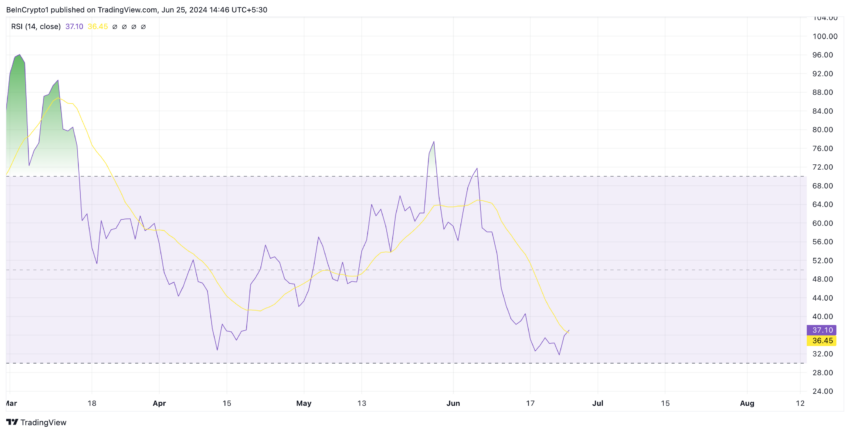

Currently, FLOKI trades at $0.00016. With many holders looking to book gains, the meme coin has been under significant selling pressure in the past few weeks. Readings from its Relative Strength Index (RSI) confirm this.

This indicator measures overbought and oversold conditions in the meme coin market. Its range is from 0 to 100, with values above 70 indicating that the token is overbought and likely due for a correction. Values below 30 suggest the asset is oversold and poised for a rebound.

FLOKI’s RSI is 37.10. This suggests that selling activity outweighs buying momentum among the meme coin’s traders. Therefore, If demand for the meme coin continues to plunge, its price may decline to $0.00014.

Read More: 7 Hot Meme Coins and Altcoins that Are Trending in 2024

However, if buying activity spikes and the sentiment towards FLOKI shifts from bearish to bullish, its price will climb to $0.00019.

Most holders of the popular meme coin Floki (FLOKI) currently have significant unrealized gains.

However, the steady decline in the token’s price has led them to adopt a bearish outlook and position themselves against any potential price rally.

Floki Prints Gains, But Holders Remain Cautious

An assessment of FLoki’s Market Value to Realized Value (MVRV) ratio shows that many of its investors currently hold their tokens at a profit.

An asset’s MVRV ratio tracks the ratio between its current market price and the average price at which each coin or token was acquired.

When the metric’s value is above one and positive, the asset is said to be overvalued. This means that the asset’s current market value is significantly higher than the price at which most investors acquire their holdings. This suggests that selling at that moment would result in profits.

Conversely, a negative MVRV ratio means that the asset is undervalued. This means that its current market value is lower than the average purchase price of all of its tokens in circulation. If traders sell, they would record a profit.

As of this writing, FLOKI’s MVRV ratio is 475.71%. At this value, the meme coin holders currently hold positions worth four times their initial investment.

Read More: What Are Meme Coins?

With such high profits available, there is a potential for increased selling pressure from investors looking to lock in their gains. This has caused FLOKI’s derivatives traders to demand more short positions in the past few days.

As of this writing, the meme coin’s aggregated funding rate across cryptocurrency exchanges is -0.03%.

Funding rates ensure the contract price stays close to the spot price in perpetual futures contracts. When it is negative like this, more traders are holding short positions.

Accordingly, it suggests that there are more traders who expect the asset’s price to fall than there are those who buy it in anticipation of selling at a higher price.

FLOKI Price Prediction: The Meme Coin Risks Falling by 13%

Currently, FLOKI trades at $0.00016. With many holders looking to book gains, the meme coin has been under significant selling pressure in the past few weeks. Readings from its Relative Strength Index (RSI) confirm this.

This indicator measures overbought and oversold conditions in the meme coin market. Its range is from 0 to 100, with values above 70 indicating that the token is overbought and likely due for a correction. Values below 30 suggest the asset is oversold and poised for a rebound.

FLOKI’s RSI is 37.10. This suggests that selling activity outweighs buying momentum among the meme coin’s traders. Therefore, If demand for the meme coin continues to plunge, its price may decline to $0.00014.

Read More: 7 Hot Meme Coins and Altcoins that Are Trending in 2024

However, if buying activity spikes and the sentiment towards FLOKI shifts from bearish to bullish, its price will climb to $0.00019.